Tax rates

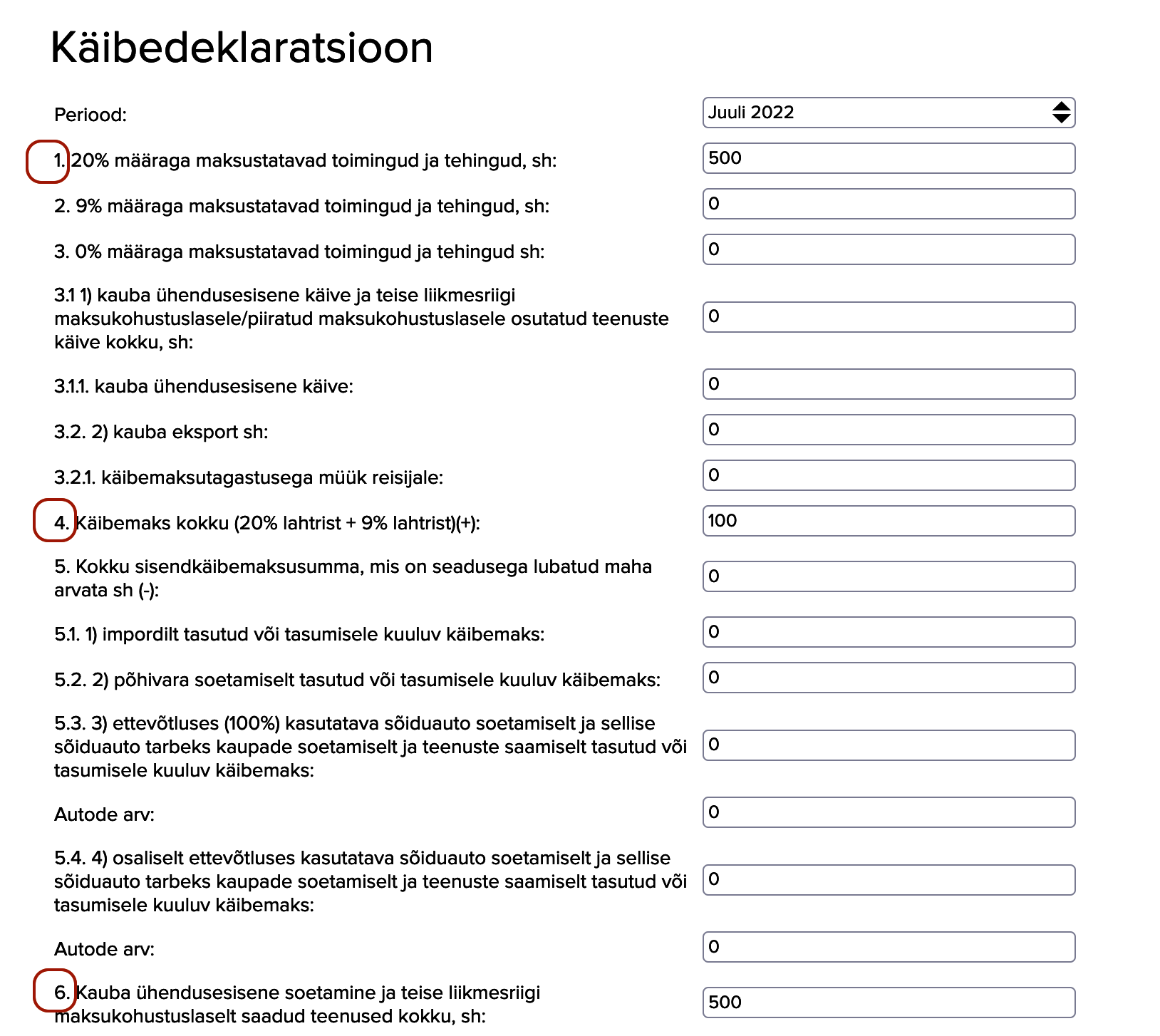

With ERPLY Books, the tax declaration is prepared using the TYPES assigned to the VAT types. The type determines which rows the data go to in the tax return. If the VAT types are set up correctly, the VAT-related information will be displayed on the correct rows of the VAT return submitted to the Estonian Tax and Customs Board.

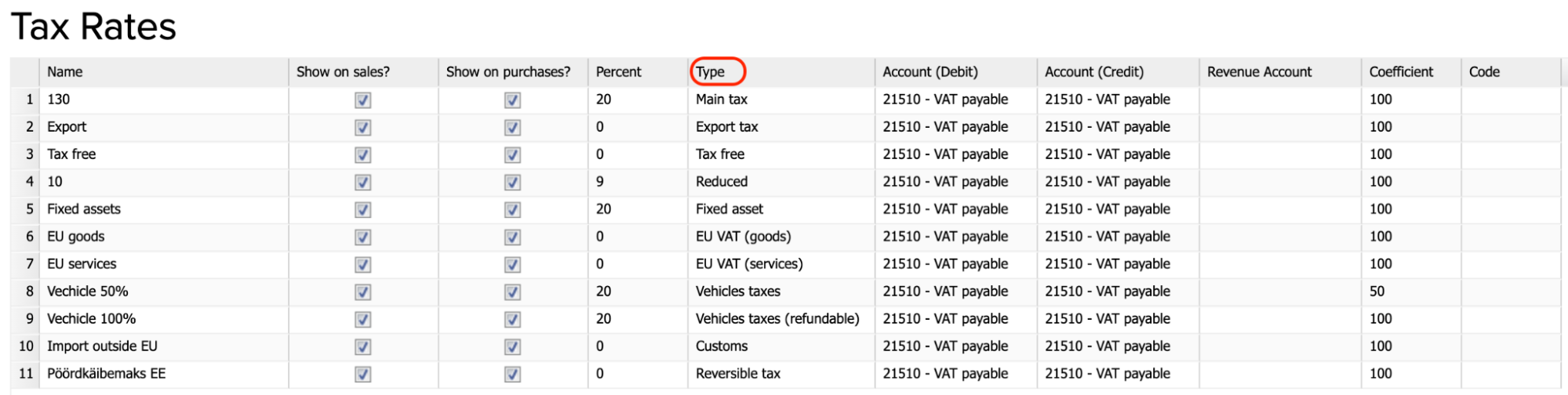

You can see the VAT types when you open “Settings” -> “Tax Rates”. In the tax rate module that opened, you can see already configured VAT types with the correct types. In addition, you can add VAT types that suit you. In the column “Name” you can see the name of the VAT chosen by you which you will see on the sales and purchase invoices. In the “Type” column, however, you can choose the type that determines which row the data go to in the sales tax return. If the data are not reflected correctly in your sales tax return, make sure to check the “Type” column.

ERPLY Books uses the following automatically configured VAT types:

| VAT type | Percent% | VAT report row sale | VAT report row purchase | Additional information |

| Main tax | 20 | 1, 4 | 5 | VAT which is always shown as the default value (except when fixed assets are purchased) |

| Reduced | 9 | 2, 4 | 5 | |

| Tax free | – | 8 | – | |

| Fixed asset | 20 | 1, 4 | 5, 5.2 | Made for the sale and purchase of fixed assets |

| Vehicle taxes | 20 | – | 5, 5.3 | |

| Vehicle taxes (refundable) | 20 | – | 5, 5.4 | |

| EU VAT (goods) | 0 | 3, 3.1, 3.1.1 | 1, 4, 5, 6, 6.1 | Made for both EU sales and purchases |

| EU VAT (services) | 0 | 3, 3.1 | 1, 4, 5, 6 | Made for both EU sales and purchases |

| Export tax | 0 | 3, 3.2 | – | Sales outside the EU customs territory |

| Import outside EU | 0 | – | 4.1, 5, 5.1 | Purchases outside the EU customs territory |

| Reversible tax | 0 | 9 | 1, 4, 5, 7 | If the organization was established before 2019, please check the “Tax rate mapping”. You can read more HERE |

| Other tax | – | – | Not placed on any row in the VAT return |

Main tax

“Main tax” is always shown as the default value when you enter a sales or purchase invoice.

The “main tax” type is used for purchase and sales invoices where the VAT rate is 20%. The transaction details are recorded on rows 1, 4 and 5 of the VAT return.

- Sales – taxable turnover is recorded on row 1 and the VAT amount on row 4.

- Purchases – the amount of input VAT is recorded on row 5.

Reduced

The “reduced” type is used for purchase and sales invoices where the VAT rate is 9%. In this case, the data of the transactions are recorded on rows 2, 4 and 5 of the VAT return.

- Sales – taxable turnover is recorded on row 2 and the VAT amount on row 4.

- Purchases – the amount of input VAT is recorded on row 5.

Tax free

The “tax free” category is used for invoices for purchases and sales where the turnover is not taxable. In the case of exempt sales, the turnover is shown on row 8 of the VAT return. Exempt turnover is only shown on the VAT return for sales invoices and not for purchase invoices.

Fixed asset

The “fixed asset” category is used in the case of purchase and sales invoices when fixed assets are bought or sold. The tax rate for “Fixed asset” is 20%.

- Sales – taxable turnover is recorded on row 1 and the VAT amount on row 4.

- Purchases – the amount of input VAT is recorded on rows 5 and 5.2.

Vehicle taxes

“Vehicle taxes” is used for purchases when you reclaim 100% of the input VAT on the car. In this case, the amount of the input VAT is recorded on rows 5 and 5.3 of the VAT return.

Vehicle taxes (refundable)

“Vehicle taxes (refundable)” is used for purchases where you deduct 50% of the input VAT on the costs related to the car. In this case, the amount of the input VAT is recorded on rows 5 and 5.4 of the VAT return.

EU VAT (goods)

The “EU VAT (goods)” VAT type is used for sales and purchases of goods within the EU. On the VAT return, the data are reported on rows 1, 3, 3.1, 3.1.1, 4, 5, 6 and 6.1.

- Sales – the transaction is reported on rows 3, 3.1 and 3.1.1 of the VAT return.

- Purchases – goods purchased from the EU are subject to the reverse charge. The purchase price is shown on rows 1, 6 and 6.1 of the VAT return. The amount of VAT is shown on rows 4 and 5. In total, the balance of the VAT due on the transaction on rows 4 and 5 is zero.

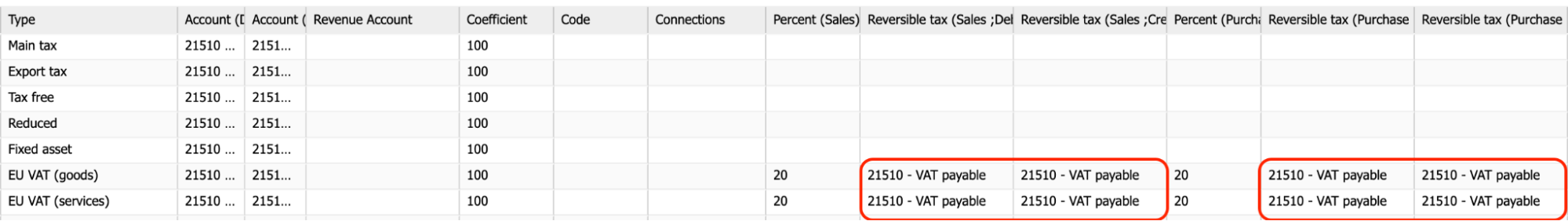

If you wish to have separate VAT amounts shown on the entries for “EU VAT (goods)”, open “Settings” -> “Tax Rates”, click on “Additional Information” and set the reverse charge VAT accounts for sales and purchases. The same applies for “EU VAT (services)”.

EU VAT (services)

The “EU VAT (services)” VAT type is used for sales and purchases of services within the EU. The VAT declaration will include information on rows 1, 3, 3.1, 4, 5, 6.

- Sales – turnover is recorded on rows 3 and 3.1 of the VAT return.

- Purchases – services purchased from the EU are subject to the reverse charge. The purchase price is shown on rows 1 and 6 of the VAT return. The amount of VAT is shown on rows 4 and 5. In total, the balance of the VAT due on the transaction on rows 4 and 5 is zero.

If you want the entries to include VAT amounts, you can set this up in the same way as for “EU VAT (goods)” (see the previous point).

Export tax

“Export tax” is used for sales outside the EU customs territory. In the VAT declaration, export turnover is recorded on rows 3 and 3.2.

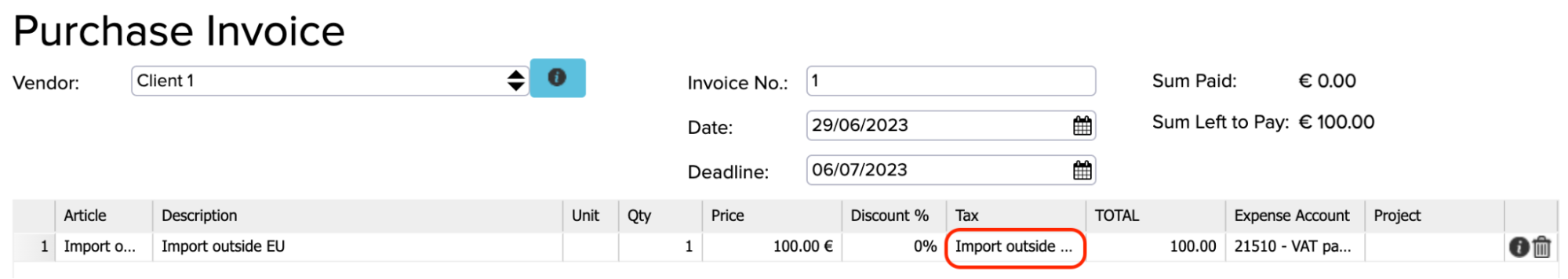

Import outside the EU

Customs charges apply to purchases made outside the EU customs territory. If you have paid import VAT to the customs authorities and you are entitled to deduct the input VAT paid on the import of goods in your VAT return, the import VAT is entered on rows 5 and 5.1 of the VAT return.

VAT on imports is used differently from other types of VAT. Usually, two invoices are required.

- Purchase invoice for goods

When entering a purchase invoice, enter the amount and select the VAT type “Other VAT”, as the purchase amount is not included in the VAT declaration.

- Import VAT invoice

On the invoice issued for import VAT, specify the input VAT account as the expense account and select ‘Import VAT’ as the VAT type. When you open “Settings” -> “Tax Rate”, you will see that “Import outside EU” is set to “Customs”. This determines that the amount of import VAT will end up on rows 5 and 5.1 of the VAT return.

You can create a separate article for import VAT to make it easier to use in the future. Open “Purchases” -> “Purchase and Sales articles”. Click the “+” button to create a new article. Choose a name that you like, for example you could choose “Import VAT” as the article name and select VAT payable as the account. Then click on the “Save” button.

Triangular transactions

A triangular transaction is a supply of goods between three traders from three EU Member States, all of whom are registered for tax in their own country. A triangular transaction is a transaction where goods are sold in two successive sales and all three parties are established in different Member States. Under a sales transaction, taxable person A (the transferor in a triangular transaction) in the first Member State sells the goods to taxable person B (the reseller in a triangular transaction) in the second Member State and the goods are transferred from B to the third Member State C (the customer in a triangular transaction), with the goods being transported directly from the first Member State (A) to the third Member State (C).

The triangular transaction type tax is used in ERPLY Books only for those transactions where the VAT Act applies a reference to Article 141 of the Council Directive 2006/112/EC.

- If the Estonian taxable person is the transferor in a triangular transaction (A), he/she declares the intra-Community transaction in boxes 3, 3.1 and 3.1.1 of the VAT return and in column 3 of the VAT return. For this purpose, the categories EU VAT (goods) and EU VAT (services) are used on the sales invoice.

2. If the Estonian taxable person is a reseller in a triangular transaction (B), he/she declares the triangular transaction in column 4 of the VAT return. Resale in a triangular transaction is not an intra-Community supply of goods and the transaction is not declared in the VAT return. In such transactions, the VAT type Triangular Transaction is used for both the purchase and sale documents.

- If the Estonian taxable person is the acquirer in a triangular transaction (C), he/she declares the acquisition in boxes 1 or 2, 4 and 7 of the VAT return. If goods have been acquired from which input VAT is deductible, the amount of VAT calculated is also shown as deductible input VAT in box 5 of the KMD. In such transactions, the tax categories EU VAT (goods) and EU VAT (services) are again used on the purchase document. In ERPLY Books, purchases with this tax type will automatically end up on VAT return rows 1 and 4.

To apply the VAT calculation for triangular transactions, go to “Settings” -> “Tax Rates”, create a new type of tax and select Triangular transaction as the type.

If the correct tax types are used at each stage, ERPLY Books will include all the necessary information in both the VAT return report file and the VD report file (Report on intra-Community supply).

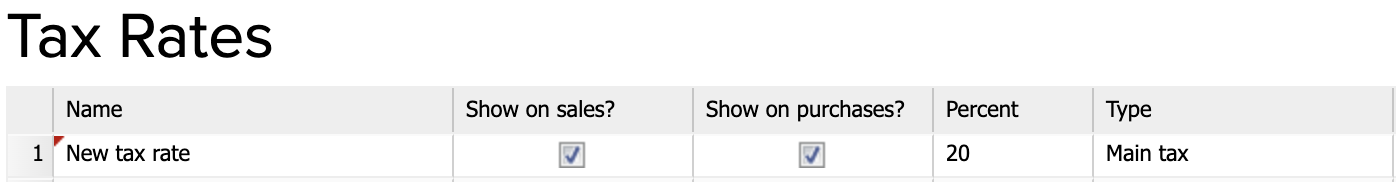

Creating a new VAT type

You can add a new VAT type by going to “Settings” -> “Tax Rates” and pressing the blue “+” button in the bottom right-hand corner. An additional row will appear where you enter the name of the new tax rate and select the required type in the “Type” column. When creating a new VAT type, you can select the debit and credit VAT accounts to which the VAT on the transaction will be linked when using this type. Click on the “Save” button in the bottom right-hand corner.

Creating an Exception as a VAT type

If you need to create a VAT type that is not yet available in ERPLY Books, you can create a VAT type that suits your business and specify that it will be entered on the correct VAT return rows. Go to “Settings” -> “Tax Rates” and select “Exception” as the type of the new VAT type (this will allow you to specify the KMD rows on which the data will be reported). Click the “Save” button.

Then go to the dashboard and type “Tax rate mapping” in the search box and fill in the following:

- Select the name of the new VAT created

- For “Type”, select the number of the row on which it will be placed in the VAT return.

- In the box “Which to show?”, select the amount to show on this row of the VAT return (sales revenue, purchase amount, VAT amount, etc.).

- Click the Save button.

VAT restricted person

Here is an example of how to set up a VAT exception for a VAT restricted person where the VAT restricted person buys goods from an EU country and has to pay the VAT to the Estonian Tax and Customs Board, but cannot reclaim the input VAT. He/she declares the purchase amount on rows 1 and 6 of the VAT return and the VAT amount on row 4.

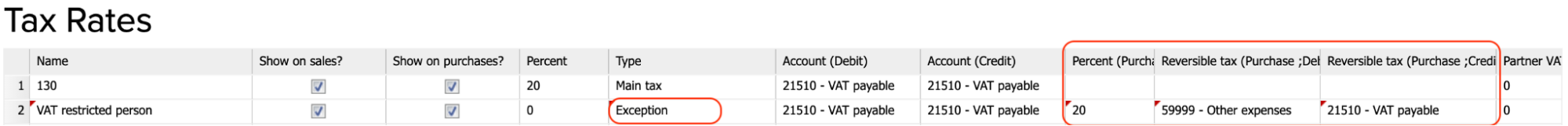

- Go to “Settings” -> “Tax Rates” and create a new VAT type. Set the percentage to “0”, select “Exception” as the type. Click on the submenu “Additional information”. This will add more fields in the table. Look for “Percentage (Purchase)” and enter 20. In the “Reversible tax (Purchase; Debit)” field, enter the expense account to which you want to apply the VAT and in the “Reversible tax (Purchase; Credit)” field, enter the VAT debit account.

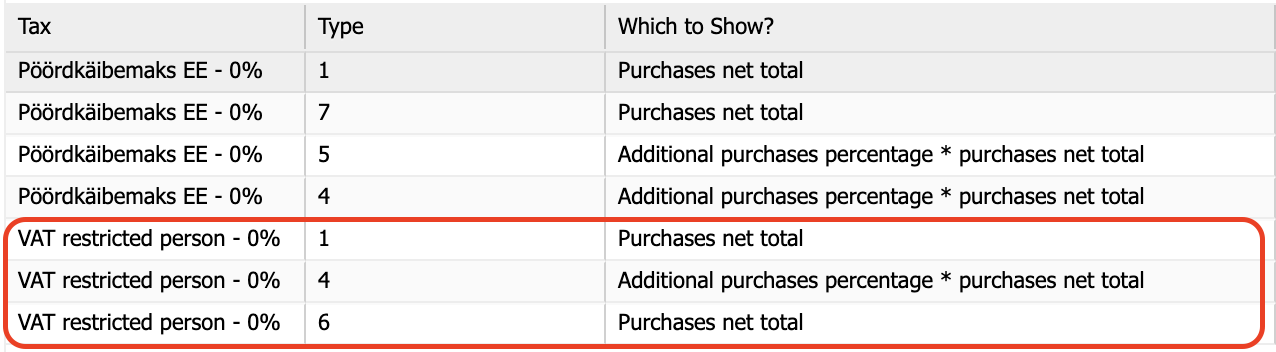

- Go to the dashboard and type “Tax rate mapping” in the search box and add the following rows so that the VAT return would show the data on rows 1, 4 and 6. Add three rows with the data in the picture and save.

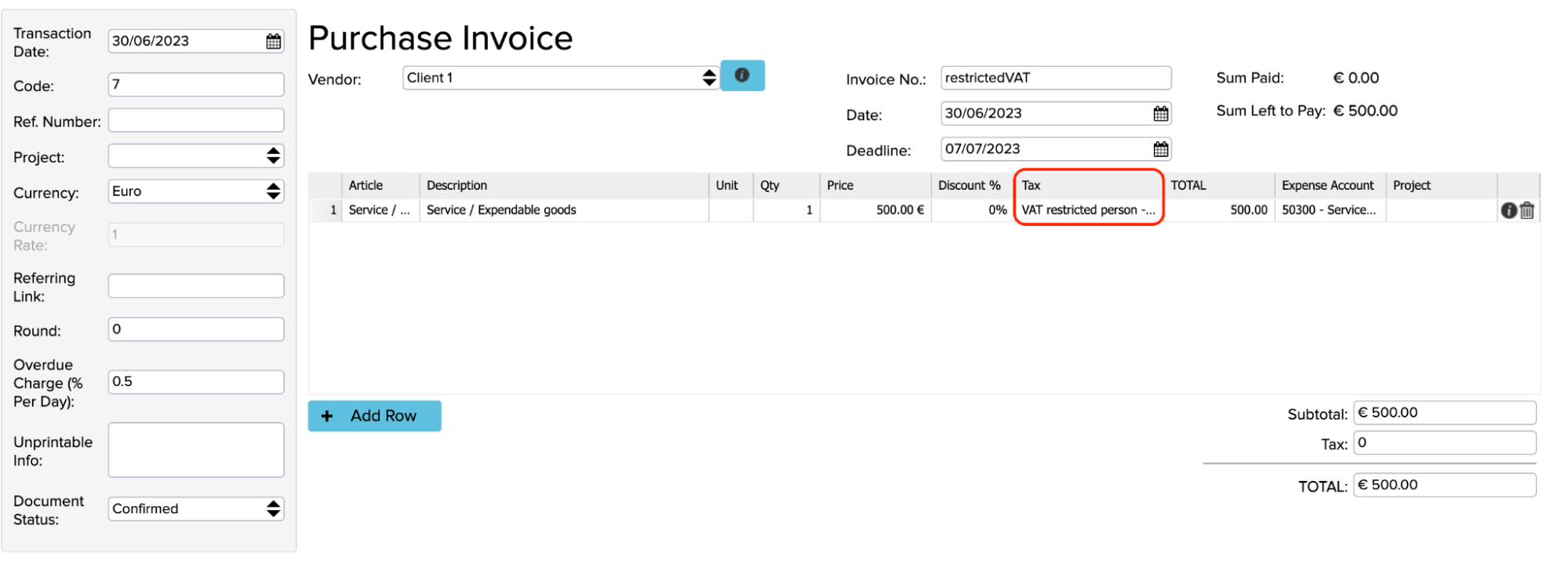

- Enter the purchase invoice and save.

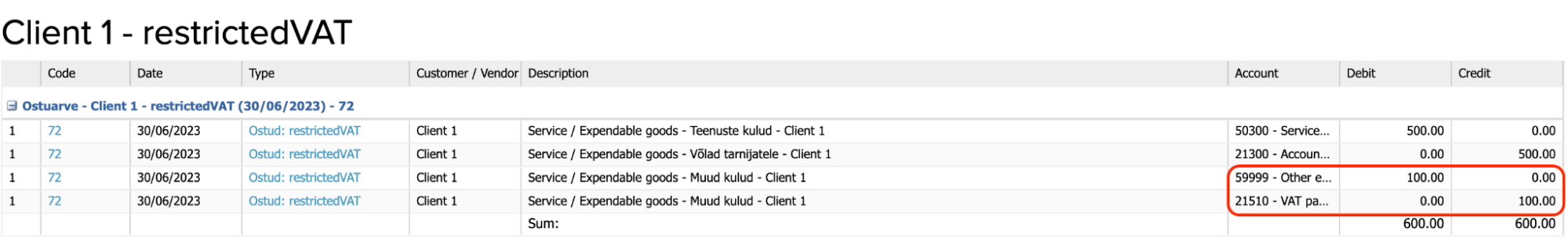

4. If you click on “Other” -> “Transactions” in the submenu, you will see a financial statement where VAT has been entered in the expense account and in the VAT debt account.

- If you open the KMD in “Reports” -> “Sales tax/VAT report” > “KMD”, you will see that the data are included on the desired rows (1, 4, 6).

Several similar VAT types

If you are using ERPLY Inventory or another external system, you may have several similar VAT types when synchronizing your data. For example, in ERPLY Books, there is a VAT called “Main tax”. If you copy the same type of VAT from an external system, called VAT 20%, you can change its name to Main tax as well. To do this, copy the name Main tax from ERPLY Books and paste it to replace VAT 20%. You will then have a single VAT type.