Foreign currency report

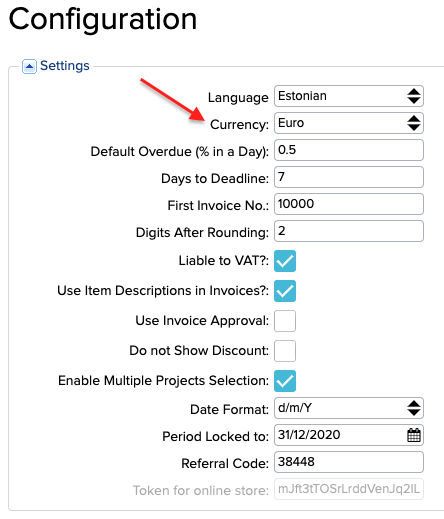

In ERPLY Books, the currencies that are not set as the main currency are considered as foreign currencies. You can see and change your organization’s main currency if you go to Settings -> Configuration.

If the transactions are made in any other currency, it is taken as a foreign currency. In ERPLY Books, it is possible to display foreign currency transactions on invoices and payments.

1. Invoices

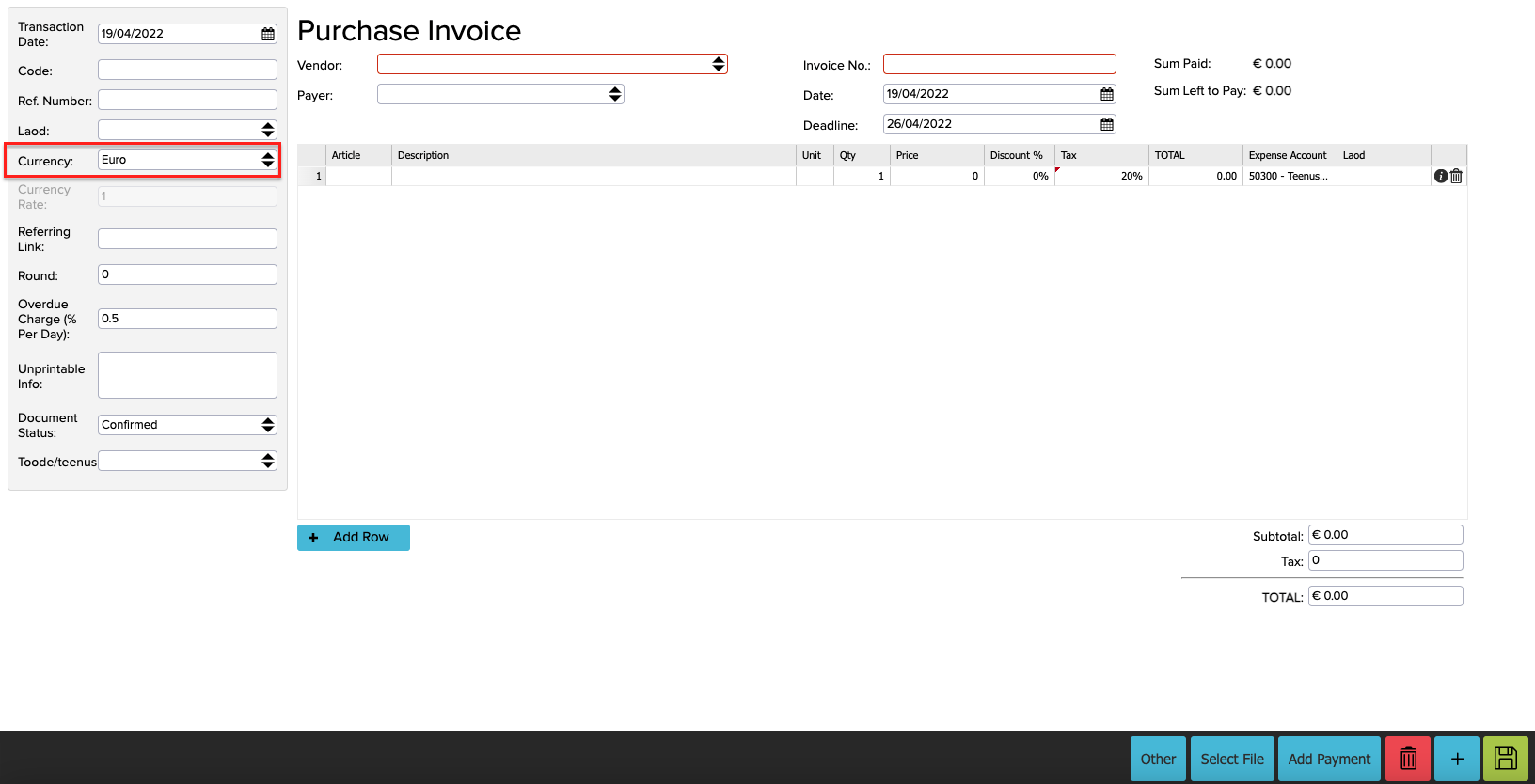

You can select the currency when creating an invoice. Let’s open a new purchase invoice, for example, to see where you can change the currency. Currency selection is available on the left. If you select a currency here which is not the main currency, it will go straight to the foreign currency report.

2. Payments

Payments can be made in a foreign currency when the receivable account is selected as the currency account.

When you open the Chart of Accounts (Accounting -> Chart of Accounts), you can see the currency that was set for each account. If any of these accounts has a different currency than the main currency, it will go straight to the foreign currency report.

In the foreign currency report you can see:

- The invoices that are in another currency

- The payments and receivables that are on the currency account

Foreign currency report

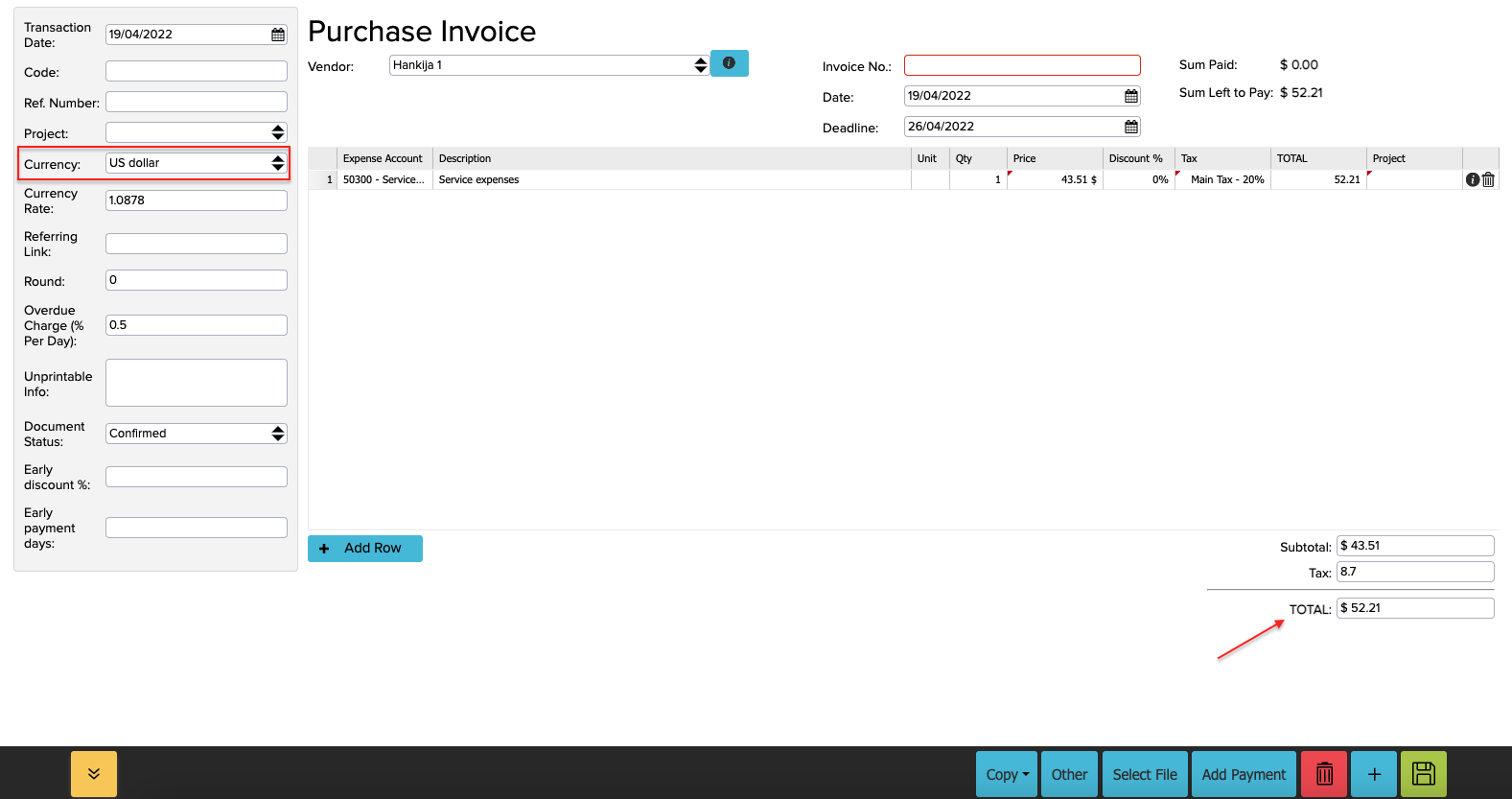

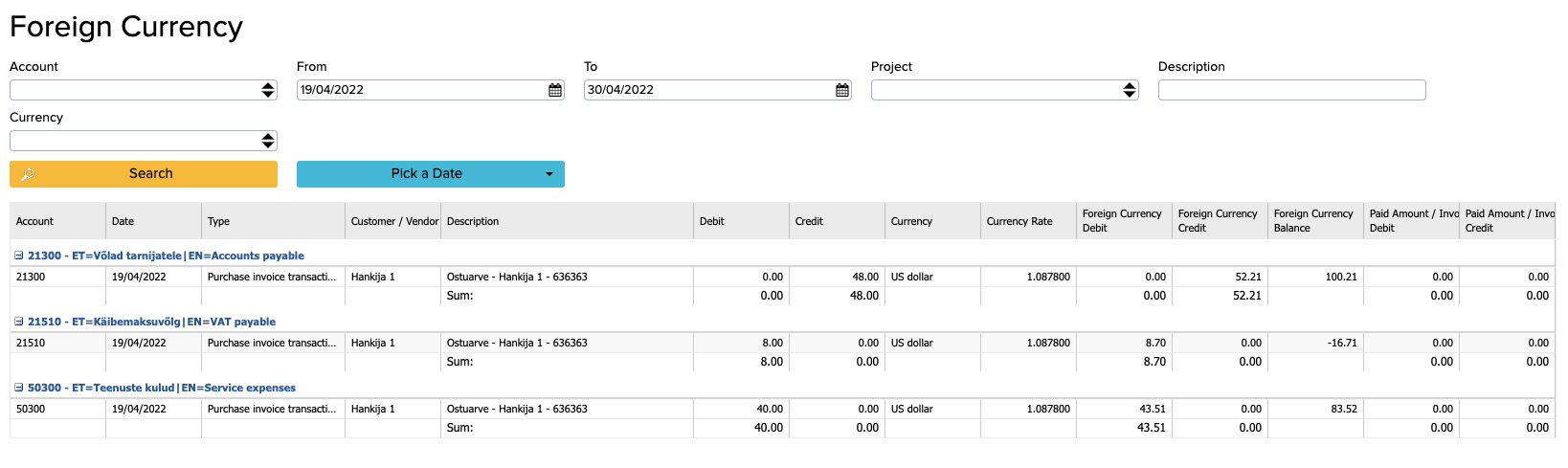

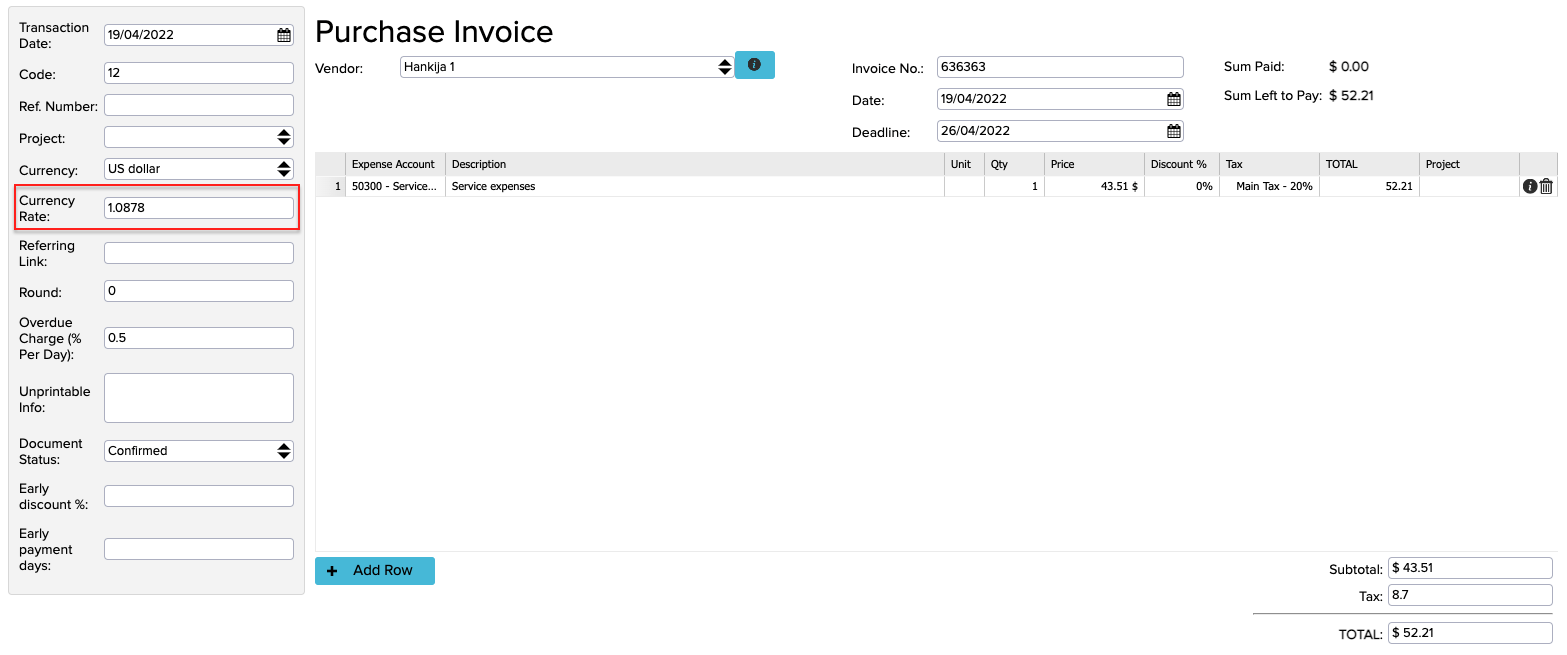

You can find the foreign currency report if you go to Accounting -> Foreign Currency. To show what information you can get from the foreign currency report, here is a purchase invoice in US dollars as an example.

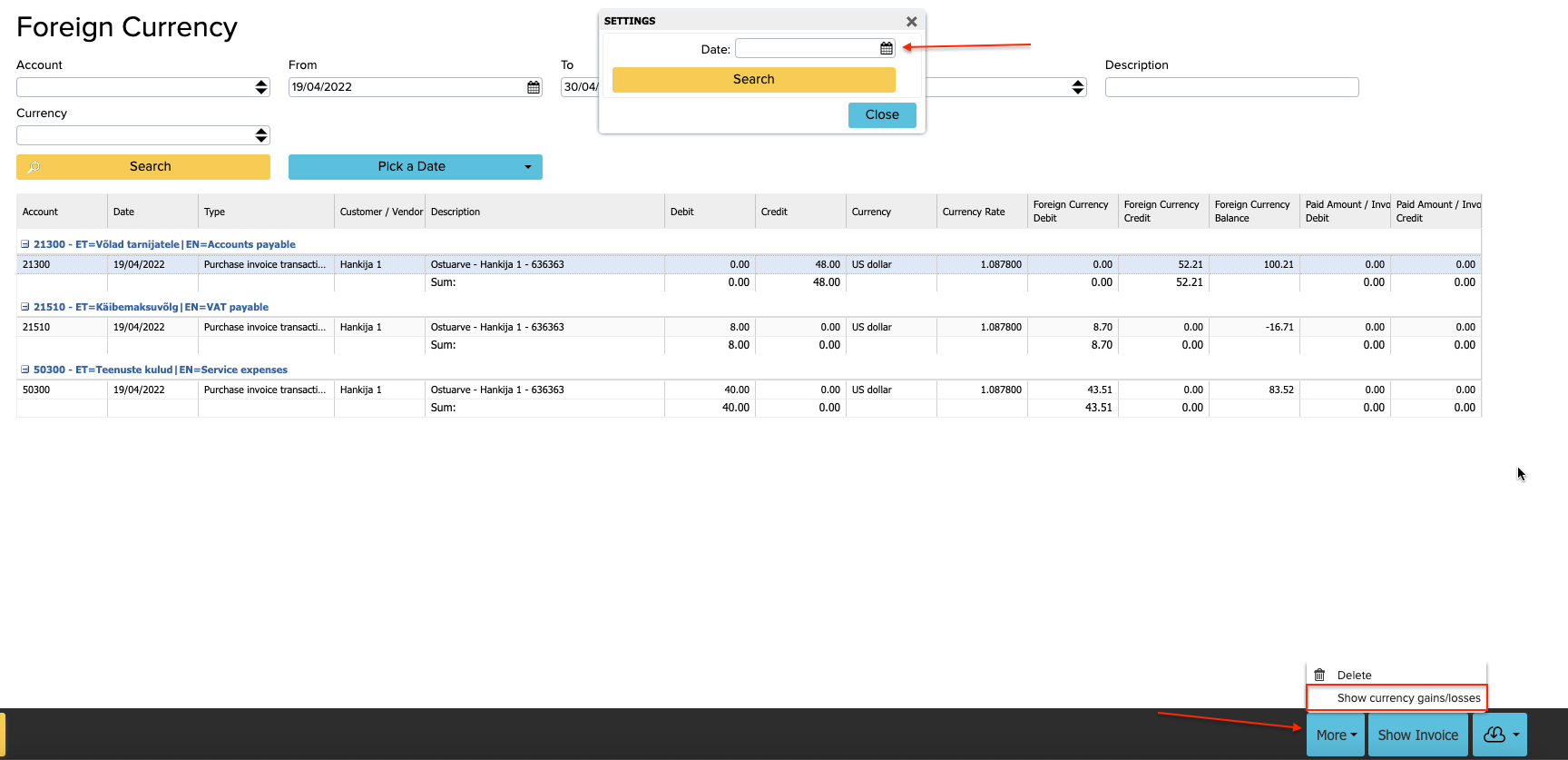

If the invoice is done, we can go to the Foreign Currency report and select the period for which we want to see the transactions. You can also specify accounts and projects. The picture below shows the information that we can see in the foreign currency report about the purchase invoice we created earlier. We can see the total in US dollars, euros, and also the balance.

We know that currency rates change all the time and here the balance is shown based on the currency rate of the time when the transaction was made. You can see this currency rate on the invoice, too (shown in the picture below in the red box). Creating a purchase or sales invoice doesn’t mean that the payment is also made at that point and by the time the sum is paid, the euro currency rate can be different in the Receivables account. Therefore, we need to create a transaction rate.

In order to see changes in currency rates, you have to activate rule number 56 under Configuration (Settings -> Configuration). If this is not activated before enabling this rule, click on the green saving button, log out of your account and then log back in.

If this rule is activated, we can compile a report on changes in currency rates. First, you have to select the relevant transaction row, click on the “More” button in the bottom right-hand corner and select “Show currency gains/losses”.

Now, a window opens where you have to select the date on which you want to adjust the difference. Select a date and then click on the yellow “Search” button. It will then show you the difference deriving from the currency rates and after clicking on “Edit”, the difference is adjusted automatically.

When adjusting differences, it is important to open balances separately for each currency. For example, if you have transactions in five different currencies, then you have to open all currencies’ balances separately and adjust them individually.