Nordigen integration

Personalize your service to your customers’ needs with open banking!

Nordigen is a one-stop solution open banking platform. They provide free access to bank data and premium access to data products for analyses and overviews. Their goal is to help businesses all around the world to adopt and utilise open banking. Nordigen’s mission is to enable greater financial transparency and financial inclusion via open banking.

Open banking provides a banking services market where the customer is granted the right to access their personal data stored by their bank, and transmit these data to any third party they choose. Shifting data ownership from banks to actual account holders not only puts people in control of their personal data but also allows them to use these data to their own advantage.

Using ERPLY Books? See how you can benefit from using Nordigen:

- Wide bank coverage – get free access to banking data from over 2,000 European banks across 31 countries. These include the most popular EU financial institutions and also Paypal, Stripe, Transferwise, and some other popular payment gateways.

- ERPLY Books users can automate and streamline their payment handling process with Nordigen because payments “flow in” every day automatically.

- You can easily measure clients’ risk levels – the Scoring tool provides ratings based on how likely a client is to repay loans through income verification and account data analysis.

- It is possible to identify patterns within data. Find transaction regularity, matches, and anomalies. Discover outliers and analyse transactional data in more depth.

- Open banking improves the relevance of services suggested to consumers which innately increases the chances of customer engagement. The more personalised a service is to a customer’s needs, the greater the chances the customer will interact with the brand, which most likely increases brand awareness.

Using Nordigen? See how you can benefit from using ERPLY Books:

- The ERPLY Books bank import functionality (which can automate up to 100% of all payments) offers unique value:

- Accountants can automate the processes of all of their small businesses by making sure all payments come to Books automatically (removing file down-file up manual labour) and using a partner panel only to handle payments that the system could not handle automatically

- If you have a website where you make sales and have made it possible for customers to pay via wire transfer – then the payment process is still automatic. For example, if a customer pays via wire transfer, then you can set Nordigen to sync once an hour, and within an hour the payment is in Books. If the customer correctly adds an order no. to the payment description, then Books can automatically connect the order with the payment and one hour after making the payment, people working in the warehouse can fill the order.

- All sizes of companies that need to handle bank payments can now automate payables-receivables

- If your accountant goes on vacation, then payments still go to Books and Books can do the accountant’s work by connecting as many payments as possible.

Just to give you an idea of what removing the tedious process of loading files up and down can do. Let’s say you need to get payments three times a day. 52 weeks, 5 days every week. This means 52*5*3=780 times. Let’s say logging into a bank, then downloading a file, and then uploading it to Books takes an average of 2 minutes. This means you can save 26h every year by just removing the time spent on downloading and uploading!

Also, this finally removes the need for updating the CSV / other format outputs every once in a while. For example, PayPal has changed its CSV file format more than 3 times between 2015 and 2022.

Nordigen integration configuration

General information about the integration

Nordigen integration works on the following principles:

- A connection with Nordigen can be created by any user who has signing rights in the bank

- You then give Nordigen the right to access your bank account

- Nordigen downloads transactions from the bank

- ERPLY Books synchronizes transactions from Nordigen and manages them similarly to other automatic bank imports (“green” transactions are saved immediately and the rest will be left waiting for a bank import)

Aspects to consider:

- Each bank can be connected once a day. If something goes wrong, you can try to reconnect with this bank on the next day.

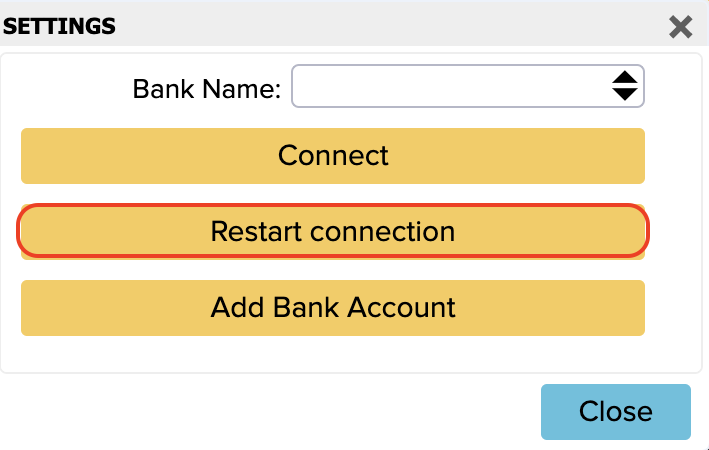

- If you have tried to connect with one specific bank already but the connection failed?, go to ‘’Settings -> Integrations -> Nordigen -> Manage ->”, select the bank and click on ‘’Restart connection’’.

- Nordigen has access to your bank account for 90 days and at the end of each 90-day period you need to update the access.

- Automatic synchronization can be configured separately

How to create a Nordigen connection?

Settings -> Organization Data -> Add the bank name, account number, IBAN, SWIFT and an account for the chart of accounts -> Save.

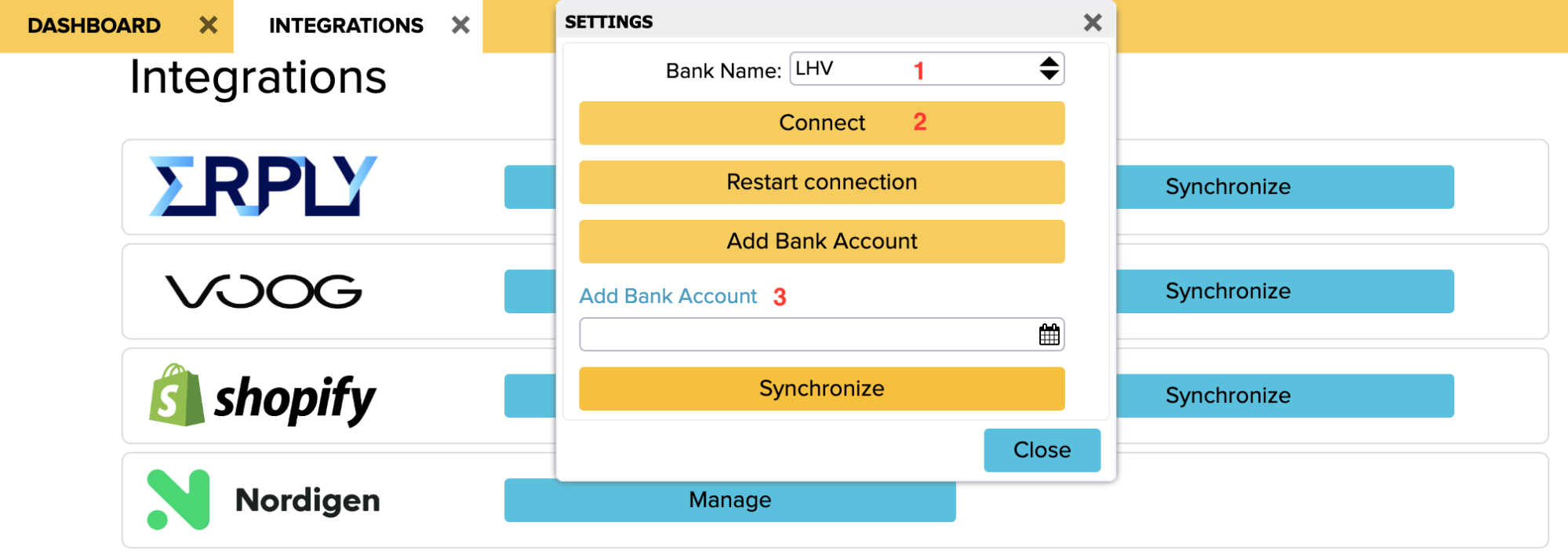

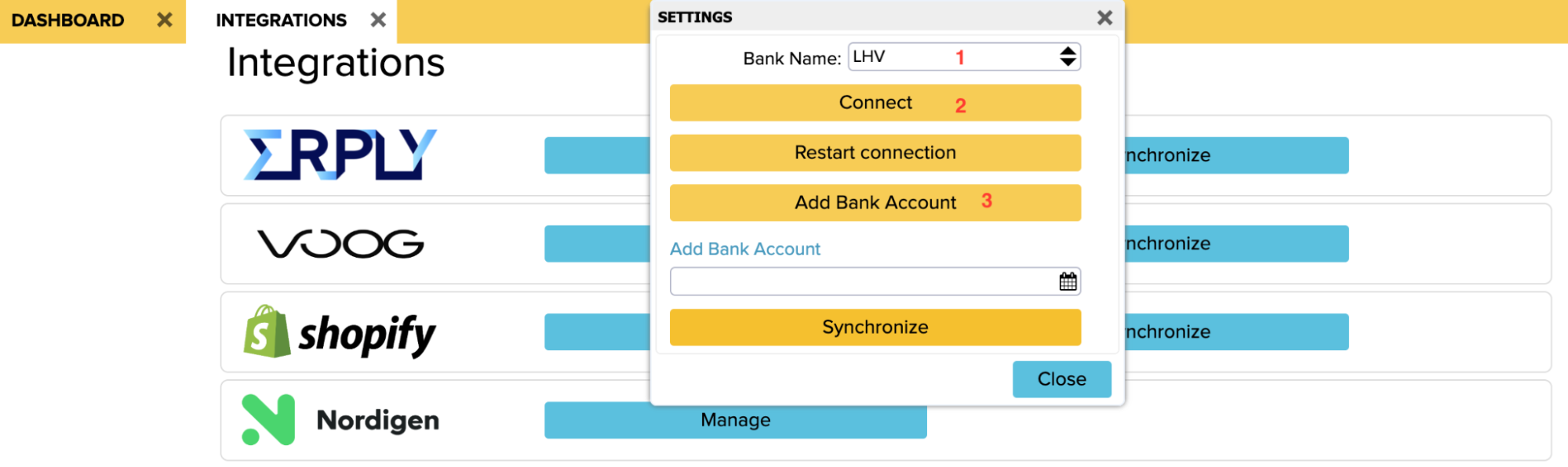

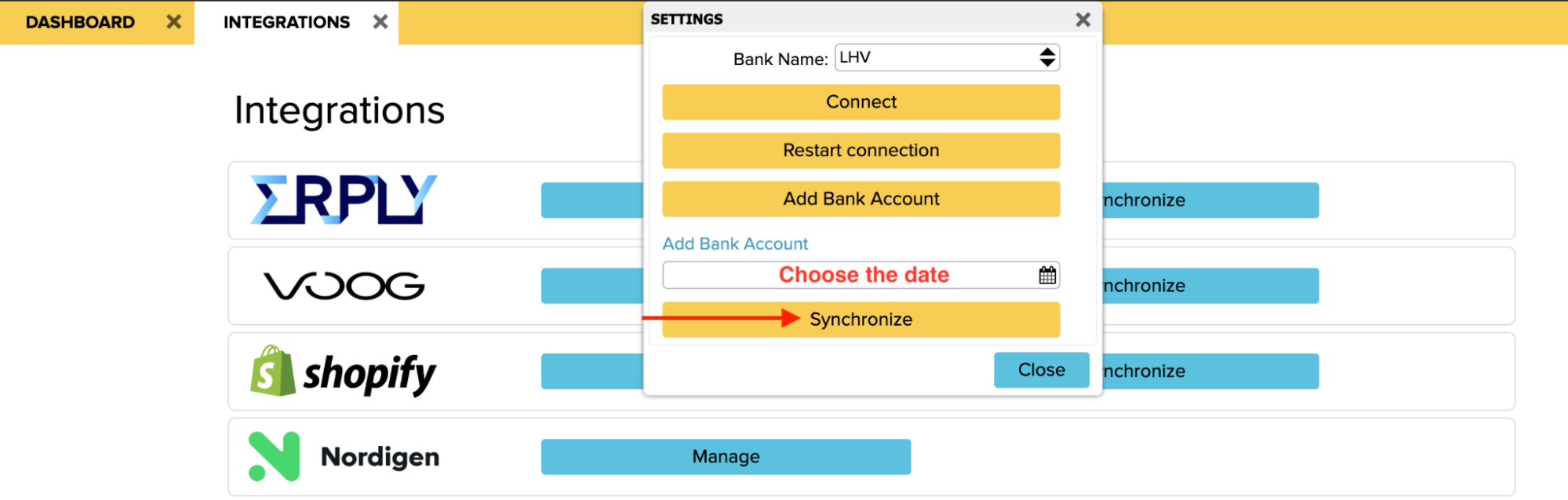

For integration, open ‘’Settings -> Integrations -> Nordigen -> Manage in ERPLY Books. Then a new window opens.

- Select the relevant bank’s name

- Click on ‘’Connect’’ to create a connection with Nordigen

- Click on the blue text ‘’Add Bank Account’’ and you will be directed to Nordigen’s page.

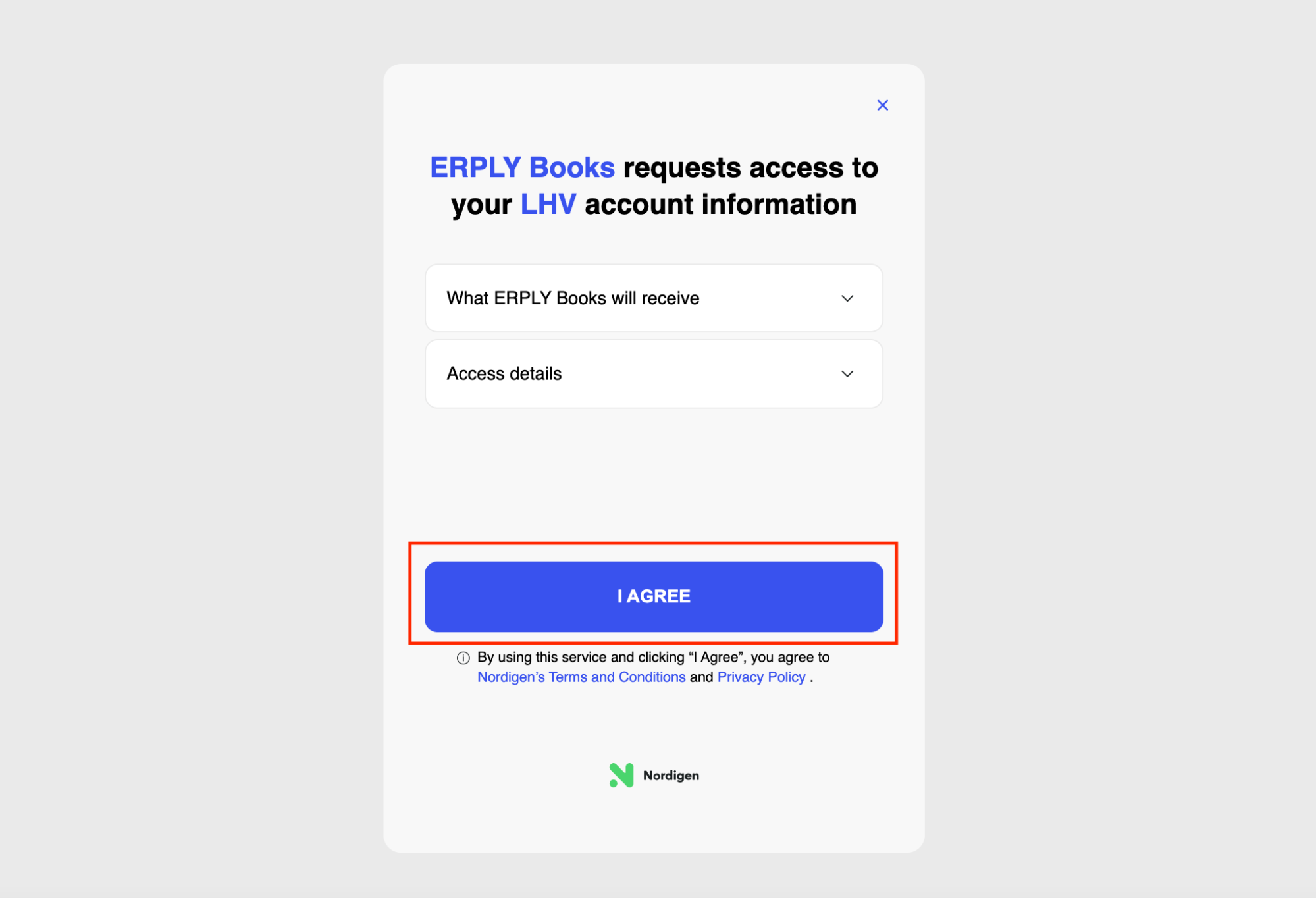

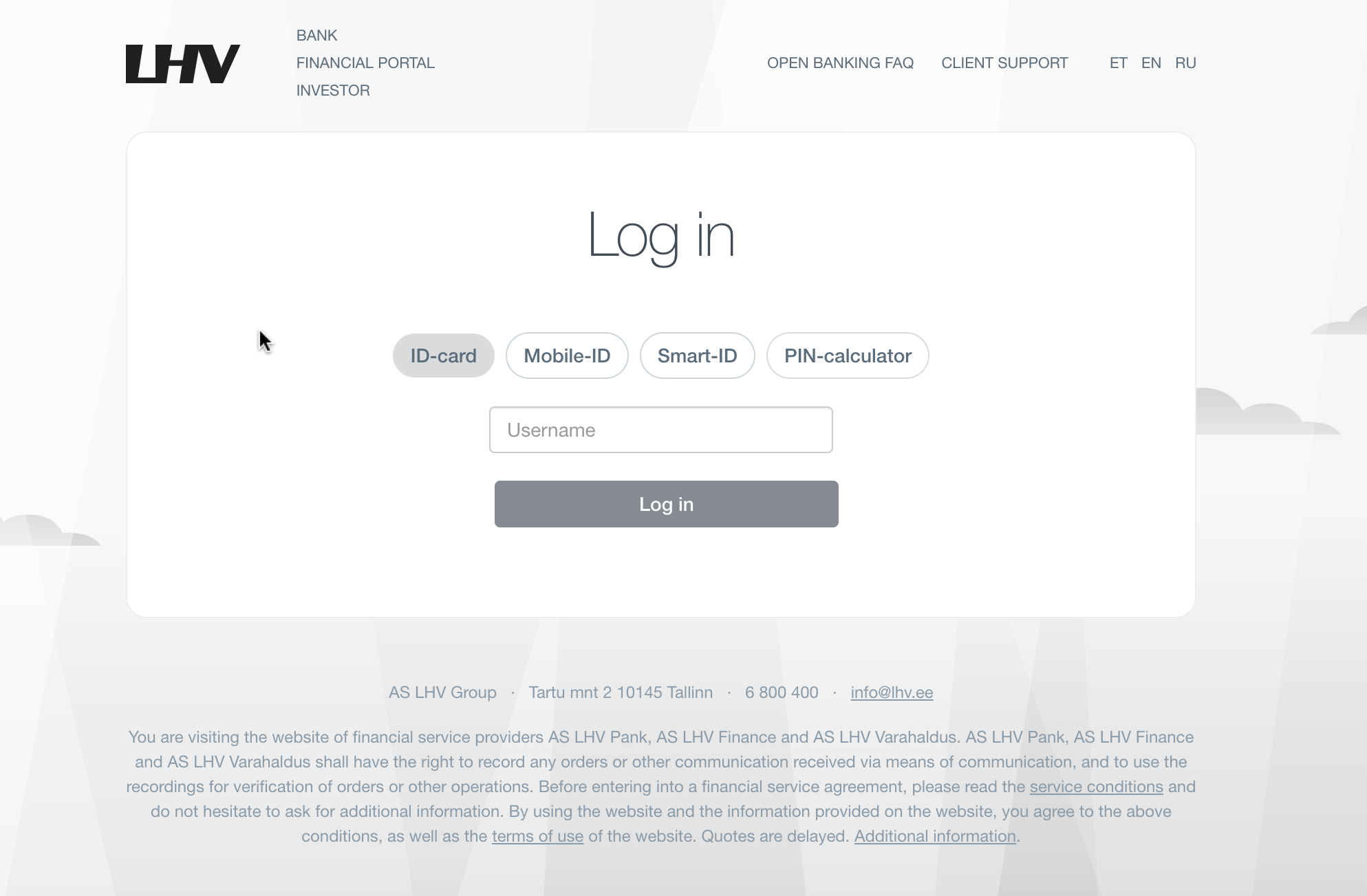

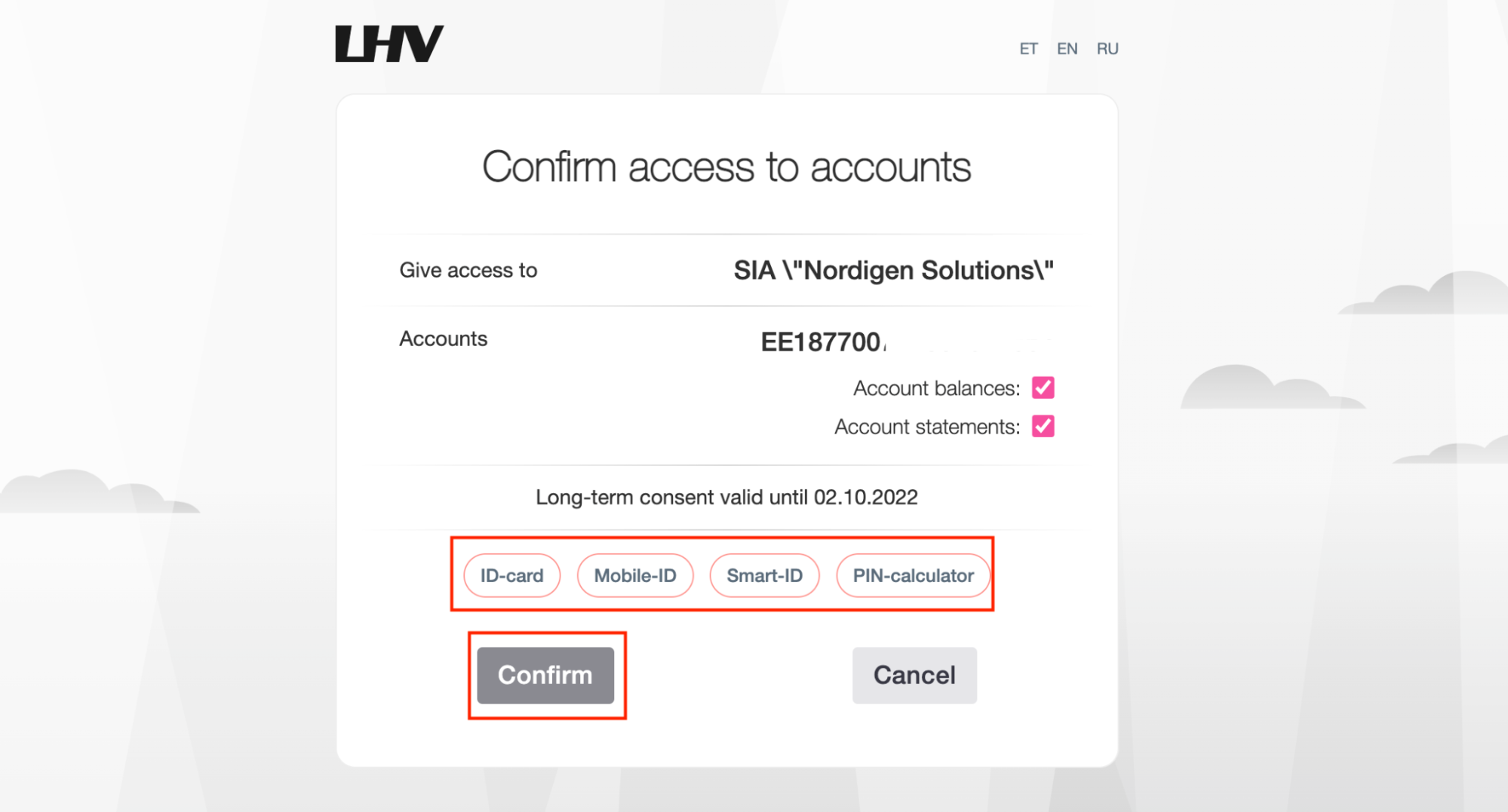

4. On the next page, the connection with Nordigen will be created. The process is further described in the example of LHV. First, the LHV login window opens.

5. After confirming, you will be redirected to ERPLY Books’ page.

6. Open ‘’Settings -> Integrations -> Nordigen -> Manage’’ in ERPLY Books and then a new window opens.

- Select the relevant bank’s name

- Click on the ‘’Connect’’ button

- Click on the ‘’Add bank account’’ button

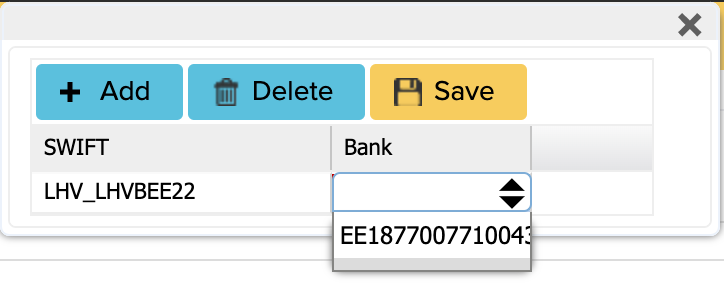

7. Do a double click in the ‘’Bank’’ cell in the pop-up window to add a bank account.

Please note! If you have several bank accounts, a new row for each of them will appear with the same SWIFT number. Select different bank account numbers for each row and click on ‘’Save’’.

8. Make sure you log out from your account and then log back in to save your changes! ‘’Settings -> Log out’’

9. You can synchronize transactions after creating a connection with Nordigen and adding bank accounts. Open again ‘’Settings -> Integrations -> Nordigen -> Manage’’ in ERPLY Books. In the opened window select the bank, click on ‘’Connect’’, select the starting date from which period you want to synchronize and click on the yellow ‘’Synchronize’’ button.

Nordigen Automatic Synchronization Rules

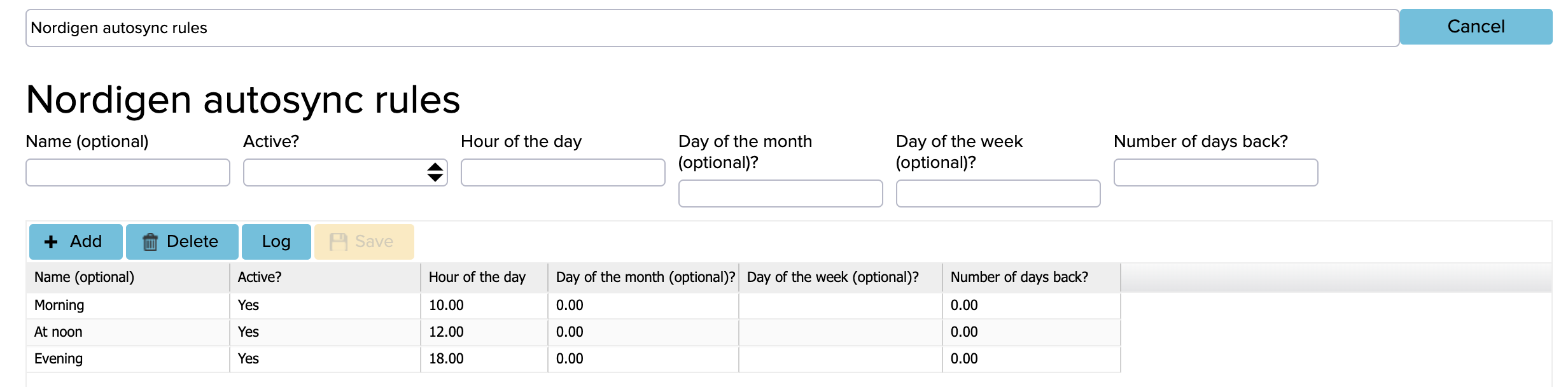

You can configure the automatic Noridgen Synchronization by searching ”Nordigen autosync rules” from the dashboard.

Active? – Yes

Hour of the day – In 24h clock timing, the number of the hourly sequence in UTC time (example: if you want the sync to take place at 8 a.m. local time, you have to set UTC time at 5.00 a.m.), then when the clock is turned, the sync time changes to 7 a.m. local time.

At the end save. the changes with yellow ”Save” button.

How to update Nordigen integration?

If you want to update Nordigen integration then follow next steps:

1. Open Settings -> Integrations

2. Find the Nordigen Integration and click on the ”Manage” button

3. Now opens a window where you have to click ‘‘Restart connection”

Next, if you want to create a new connection with Nordigen, the process of creating a connection is the same as described in the “How to create a Nordigen connection?” chapter.

If you have any further questions, please contact us at support@erplybooks.com.