Minimum limit on VAT sales & purchases in Lithuania

In Lithuania there is no lower limit on sales and purchases, all VAT transactions must be declared, invoice by invoice.

Types and rates of VAT

In Lithuania, there are numerous tax rate types that are reflected in tax declarations. Below you will find the description of the main types, how they may be added, which PVM code they correspond and how add exceptions.

The main tax types and their PVM codes that are by default supported in ERPLY Books and are already listed in the system:

Sales:

- Main Tax Rate -> PVM1

- EU products or EU reduced VAT products -> PVM13

- Reduced (9%) -> PVM2

- Reduced (5%) -> PVM3

- Fixed assets (21%) -> PVM9

- Fixed assets (9%) -> PVM30

- Fixed assets (5%) -> PVM31

- Export -> PVM12

Purchases:

- Main Tax Rate -> PVM1

- EU products -> PVM16

- EU services -> PVM21

- EU services reduced -> PVM40

- Reduced (9%) -> PVM2

- Reduced (5%) -> PVM3

- Fixed assets (21%) -> PVM9

- Fixed assets (9%) -> PVM30

- Fixed assets (5%) -> PVM31

The Code column is only filled in for illustrative purposes, so you see the connections between the main tax PVM codes and tax types themselves. It is not necessary to fill them in.

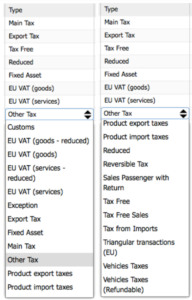

To add a new tax rate, go to Settings > Tax Rates. All necessary tax types may be found in the Type column (see the screenshot).

There click + and pick the right tax type (see the screenshot with all tax types below).

An exception in this case is a manually added tax type with a manually assigned PVM by the user. In order to add an exception tax type, go to Settings > Tax Rates. Click +, pick Exception in the Type cell. (See the screenshot below).

Once you’ve added the tax Name, Type, Percentage and its Code, click Save.

The procedure is the same for each new exception.

Different VAT iSAF invoice types in Lithuania

In Lithuanian iSAF there are several types of VAT invoices, see the list below.

Mark type of the VAT invoice:

- SF (or an empty element) – a VAT invoice – by default for any positive invoice

- DS – a debit VAT invoice,

- KS – a credit VAT invoice, (i.e. the amount is negative, e.g. return of goods)

- VS – one summary VAT invoice (issued by attorneys-at-law / notaries public),

- VD – one summary debit VAT invoice (issued by attorneys-at-law / notaries public),

- VK – one summary credit VAT invoice (issued by attorneys-at-law / notaries public),

- AN – a cancelled VAT invoice – not supported

SF and DS types are supported in ERPLY Books by default. All other types have to be added directly to the invoice manually. To do this, create a purchase or a sales invoice and add the desired invoice type to the Unprintable Info cell in the following format: isaf-type:DS.

DS is a debit VAT invoice, which is issued by the customer in case of returning the goods. As a vendor, in this case your task is to add a KS invoice in ERPLY Books and to add the DS invoice number to the Referring Link cell. E.g. a business customer sends you a DS invoice with the value of 500€ and their own invoice number 14559689. See the screenshot below to find out how to fill the information in.

Can I add sales/purchases to my declaration from different software?

Yes. In Lithuania, your sales and purchases may be separated while filling in the VAT declaration. E.g. you record your sales in one software and purchases – in another software. In this way, you can group your sales and download an XML, and separately do the same for purchases.

Can I filter out VAT-free or non-VAT reliable customers/vendors while filling in the VAT declaration?

Yes, ERPLY Books provides a solution to filter out some customers. The government usually only monitors the sectors, where a tax fraud may come from. So, this doesn’t apply to those, who can’t claim the VAT back (like foreign-EU companies, with whom you trade at 0% VAT, or non-VAT reliable legal entities). Hence, you may filter out such entities from your declaration in ERPLY Books. You can make a custom list of customers/vendors, which will not be included into your VAT declaration. To do this, go to the Dashboard > in the Search window type Customers & Suppliers You Don’t Need to Declare. Once the form is open, you may add all necessary vendors/customers from your contacts (see the screenshot below). Don’t forget to click Save for the changes to come into force.

Which declaration should I add a certain expense to, if the transaction date and the invoice date differ?

According to the accounting rules, the transaction date identifies, which month’s declaration your invoice goes to. In ERPLY Books you have the invoice date and the transaction date fields, you need to fill in both. E.g. on 5th of April you receive the internet provider service invoice for March. This means that current transaction goes to your March declaration, as the service provision occurs in March.

What do I do if my customer/vendor does not have a VAT number?

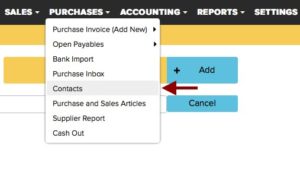

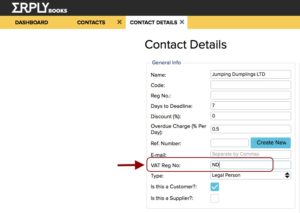

The following information applies for Lithuanian companies only. If your customer or vendor doesn’t have a VAT code, you put ND in the corresponding field. Go to Purchases > Contacts. Click on the Information button against the contact you want to edit. In the VAT Reg No field add ND. Now click Save.

NB: it is an important thing to do, otherwise you will get an error message from the Tax Office.