Minimum 150€ limit on VAT sales & purchases in Latvia

In Latvia, if you are VAT liable, according to law, your company has to declare all sales and purchases with VAT done for more than a 150€ with one vendor/customer, every single invoice. This is done in order to prevent the VAT fraud. Your regular declaration is filled in as usual, declaring the suppliers and customers with the turnover of >150€ is done separately. Sales and purchases at <150€ are indicated altogether in the main declaration that you submit to your local tax office. If you have two different branches of the same business added under the same registration number (like Rimi Riga and Rimi Bauska), their transactions get aggregated, which means that if you have sold or purchased for 80 eur from Rimi Riga and for 71 eur from Rimi Bauska, the total is 151 eur, and you have to declare each invoice individually instead of just submitting the total amount of your sales/purchases.

Types of Reverse VAT and its settings

There are several types of activities, where the Reverse Charge VAT applies for domestic transactions. These are:

–Darījumi ar kokmateriāliem (R1) – Dealing with timber

–Darījumi ar metāllūžņiem (R2) – Dealing with metal scrap

–Būvniecības pakalpojumi (R3) – Construction services

–Mobilo telefonu, planšetdatoru, klēpjdatoru un integrālās shēmas ierīču un spēļu konsoļu piegāde (R4) – Supply of electronics

–Graudaugu un tehnisko kultūru piegāde (R5) – Growing cereals and delivery of industrial crops

–Neapstrādātu dārgmetālu, dārgmetālu sakausējumu un dārgmetālu plaķētu metālu piegāde (R6) – Unprocessed precious metals etc.

–Darījumi ar metālizstrādājumiem (R7) – Transactions with metal products

–Sadzīves elektronisko iekārtu un sadzīves elektriskās aparatūras piegāde (R8) – Delivery of consumer electronics and household electrical equipment

–Būvizstrādājumu piegāde (R9) – Delivery of construction products.

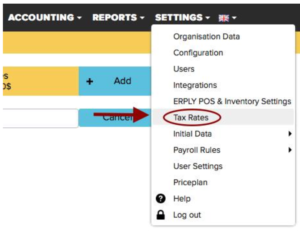

As of June 2018, when you create a new organisation, all these rates will be in your Tax Rates menu by default. For organizations that were registered in ERPLY Books before June 2018, to have these rates at your disposal, you need to add them in the system manually. First, go to “Settings” > “Tax rates”.

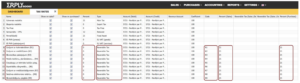

There you click on the + to add rows and fill all necessary fields exactly like on the screenshot (the Name of the tax can be edited in any way, it won’t affect the system or the VAT report). Percent (Sales) and Percent (Purchase) columns are initially hidden, to see them click Additional Information.

Your settings for the Percent, Type, Percent (Sales) & Percent (Purchases) have to be exactly like on the screenshot in order to make the system add amounts to the VAT declaration correctly.

After adding the tax rates, click Save and refresh the page for the changes to come into force.

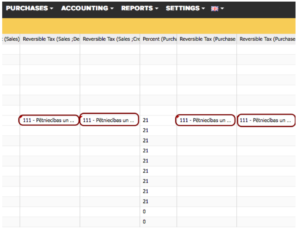

Additionally, you have an option of reflecting all your Reverse Tax amounts on separate accounts, which you may choose or add in your organization’s Chart of Accounts. This feature comes in handy when you are having an external audit, as nominally ERPLY Books does not reflect Reverse Tax amounts anywhere, since the tax rate is zero.

The screenshots below illustrates where accounts for the Reverse Tax amounts should be added. Click Save and refresh the page after you’ve done changes in the Tax Rates module, so the changes come into force.

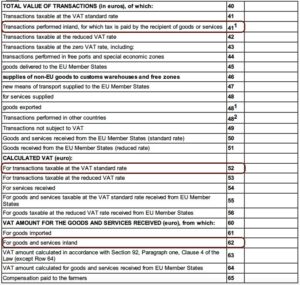

In your monthly VAT declaration there are three fields, where reverse tax (R1-R9) amounts appear:

-Sales amounts appear in the row 41.1

-Purchase amounts appear in rows 52 & 62 (see the screenshot below)