Prepaid expenses

Prepaid expenses are used if the company receives an invoice for a future period that must be divided into equal parts over future months. For example, the company may receive an insurance invoice of 120 euros for one year for the period from 1 January to 31 December 2020 and the insurance cost of 10 euros must be shown for each month.

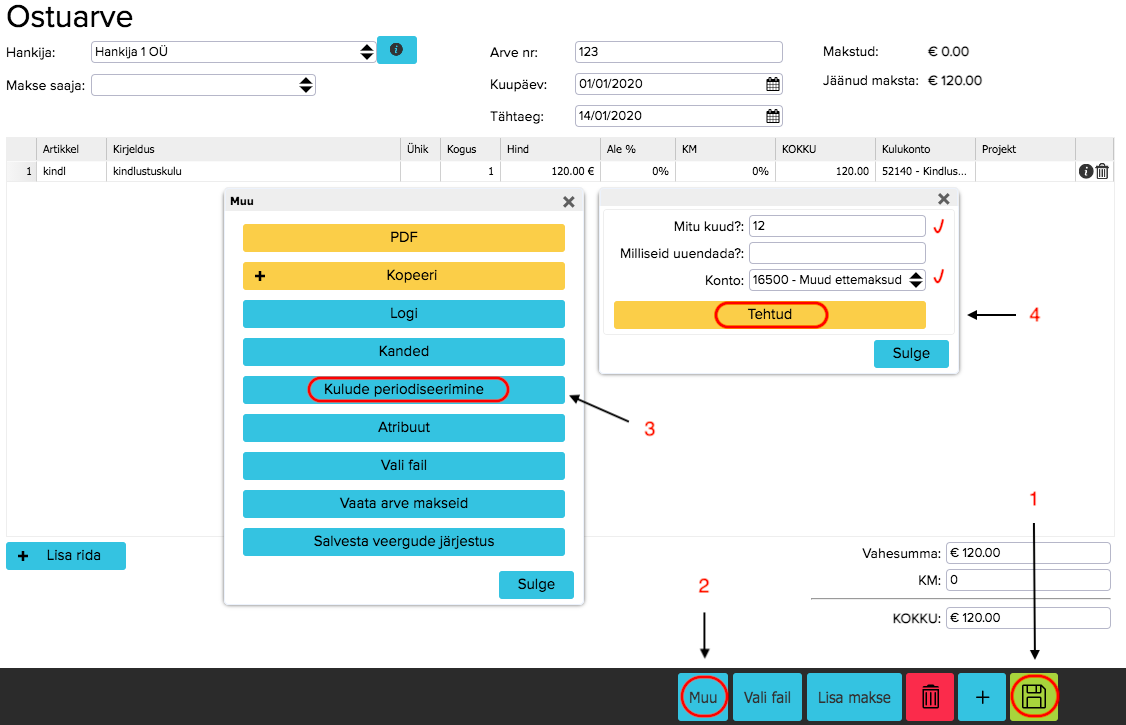

Complete the following steps for prepaid expenses. If you have received an invoice, show it in your accounts as a regular purchase invoice. As the account, choose an expense account (not an prepayment account). In the lower right corner, press the blue button More and select Prepaid expenses. A window will open where you will need to fill in the following fields:

- How many months? – choose the number of months.

- What should be updated? – choose the invoice lines that prepaid expenses should be applied to. If you wish to apply prepaid expenses to all lines, leave this field blank. If you wish to apply prepaid expenses to specific lines, separate them with commas (e.g. 1,3).

- Account – choose the prepayment account on which the expense of future periods should be reflected.

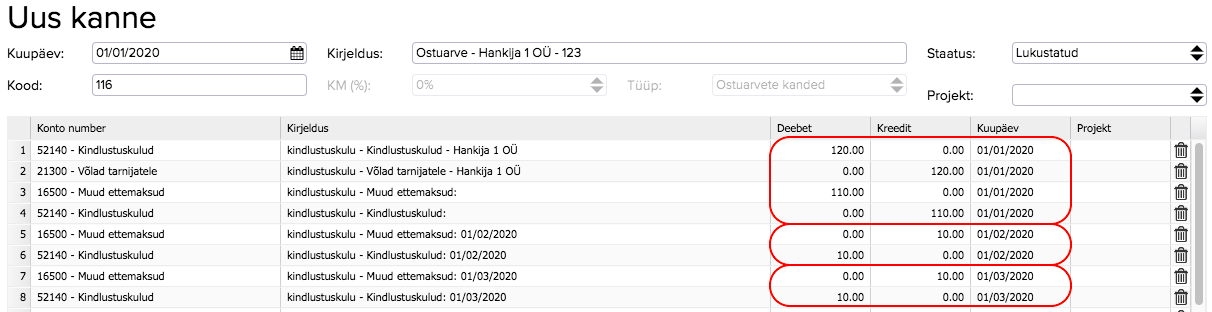

After clicking ‘Done’, an accounting entry will open. The accounting entry shows that the entry is divided by dates. In the first month, the payment amount for the following 11 months is transferred to the prepayment account and the amount for the first month is left on the expense account. Starting from the second month, the correct amount is transferred from the prepayment account to the expense account.

Once everything seems to be correct, click the green Save button in the lower right corner.