Reversible tax

This manual will introduce reversible tax and explains how to make corresponding settings in ERPLY Books.

1) What is it?

This is a tax where the vendor of the service or product has the profit but the person who receives the service or product must pay tax. Tax rates are set according to the Tax Office. Both, the vendor and the customer must have valid VAT register number.

It helps to avoid tax evasion. When two legal entities submit each other invoices and both of them are taxable persons, then this transactions has a 0 tax rate for the Tax Office.

Example

When A buys from B in amount of 100 EUR + VAT, then:

- A declares VAT in amount of 20 EUR and will ask 20 EUR back from the Tax Office.

- B declares sales in amount of 100 EUR- pays 20 EUR.

- In total 20-20=0 EUR

In order to avoid A paying VAT in amount of 20 EUR and B avoids declaring the sale, then we use reversible tax. A pays 100 EUR to B, not 120 and nobody do tax fraud.

2) How to set it up?

Log in to ERPLY Books and go to “Settings” > “Tax rates”. Add a new tax rate by clicking on the “+” button in the menu below.

The type must be “Reversible tax” and the tax percent “0”.

2.1 How to show reversible tax in transactions but not on the invoice?

In order to do that, go to “Settings” > “Tax rates” and click on the button “Additional information”. Then fill in information about sales or purchase and add the accounts. Save.

Now, if you add reversible tax on invoice, then next transactions will occur:

Example: We have an invoice in amount on 100 EUR:

D: Expenses: 100 EUR

C: Debts to suppliers: 100 EUR

D: Reversible tax debit account 20 EUR (if you add 20% as percent)

C: Reversible tax credit account 20 EUR (if you add 20% as percent)

3) How to show reversible tax in VAT report?

In ERPLY Books, VAT report is compiled based on types that are determined in “Settings” > “Tax rates”. The type of the reversible tax must be “Reversible tax”.

Because reversible tax might have different rules, then in order to show it on the right rows of the VAT report you should add extra rules. You will find this module when you type “Käibemaksu lisareeglid” into the dashboard searchbox.

Adding the rules in this module:

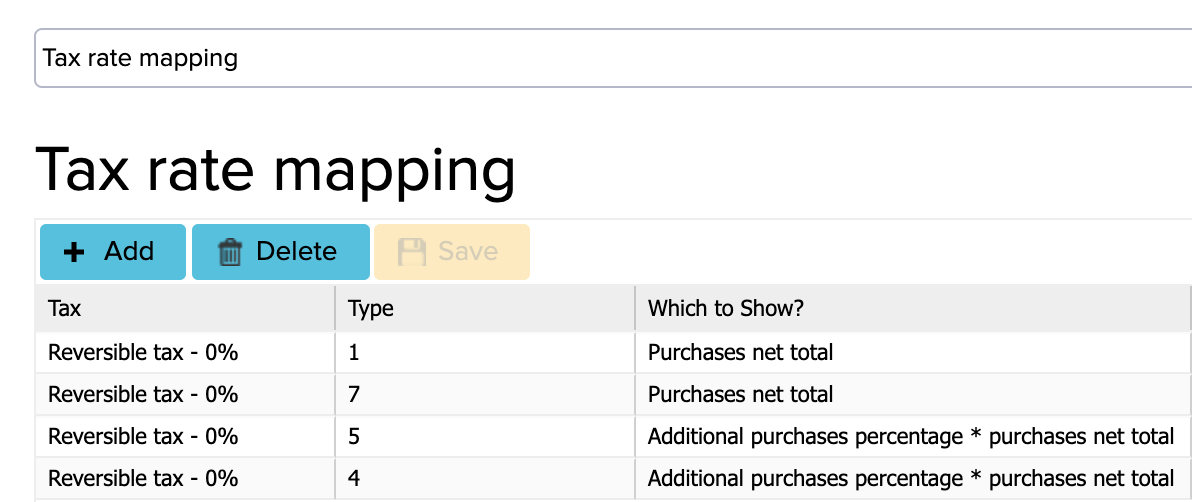

- Open the dashboard and type in “Tax rate mapping”.

- The module will open. In the first column, choose tax rate that you want to add rules to. In the second column, add the type (this determines on what row the tax is shown in the Tax report) and in the third column choose invoice type (Purchases net total or Sales net total).

On the picture you can see how to set the import VAT when you need to show it on the rows 1, 4, 5 and 7.

*Additional purchases percentage * purchases net total is a VAT that must be shown as a reversible tax. This percent can be set under “Settings” > “Tax rates”.

4) Metal VAT – Set up for the ERPLY POS customers.

Log in to ERPLY. Go to “Settings” > “Set up tax rates”. Add a new tax rate by clicking on “+”. Type in the tax rate’s name “Metal VAT”, add 0% for the tax percent, make a tick in “Reverse VAT”, add 20% as the rate of reverse VAT. Then save.

Then do like described in the 2nd chapter of this manual.