Locking data and closing a period

Lock your data if you have organised them and you do not want it to be changed in the future. You can always undo the locking by changing the locking date or the transaction status. Locking does not close a period.

Locking data

You should use the option for locking periods for if you have completed the accounting for a certain period and you wish to make no further changes. You can lock an entire period as well as specific accounts, invoices, or entries.

If you have completed the accounting for a certain period (submitted all reports for that period), you can also close this period on ERPLY Books. In the case of any errors, all actions mentioned above can be undone.

Locking a period

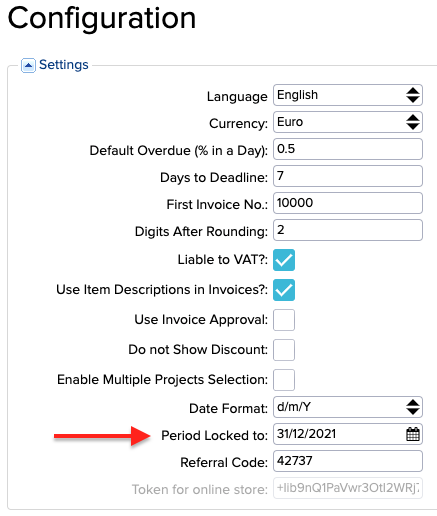

To lock a period, open ”Settings -> Configuration” and determine the locking date in the cell ”Period locked to”.

The data bearing the date in this cell or an earlier one have now been locked. No changes can be made before the locking date – if you attempt to, you will receive an error message. If you need to make changes in a locked period, you will need to change the date of the locking to an earlier one, then save, and refresh the browser (so that the changes are applied). This way, you can make changes in a period that you have locked previously. Reset the locking date afterwards. For example, if a period is locked until 31 December 2021, but you need to amend an invoice from 1 September 2021, you should set 31 August 2021 as the locking date, which allows you to amend the invoice. Later, if you wish to lock all of 2021, you will need to reset the locking date.

Locking an account

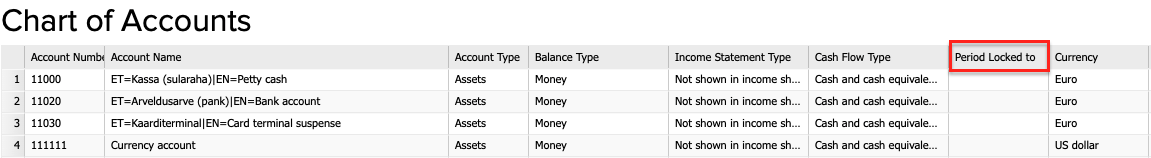

To lock accounts, select Accounting -> Chart of Accounts, where you can set a locking date for the required account in the column ”Period locked to”

Until the set date (including that date), the balance of the account will be locked. If you wish to amend the account balance of the locked period, you will need to amend the date. After amending the date, you will need to save the changes to apply them.

Locking an invoice

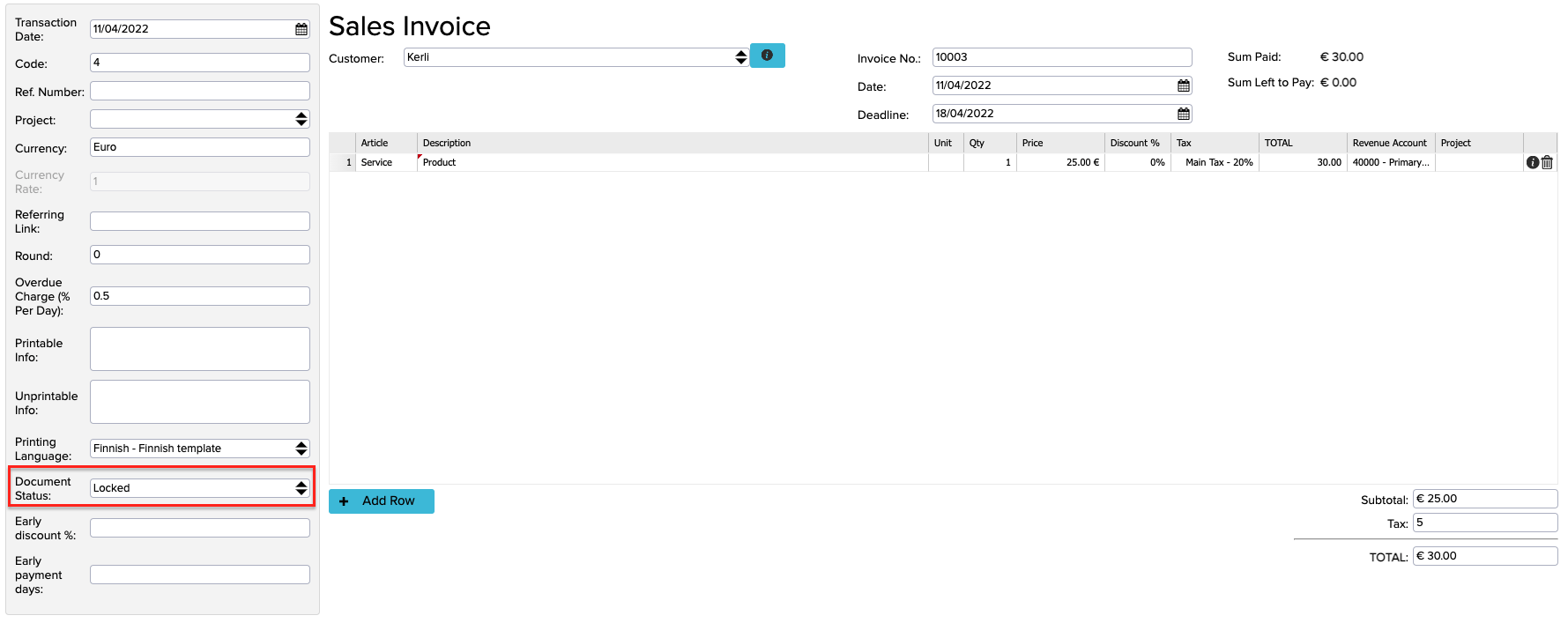

Invoices can be locked under the additional information of an open invoice by selecting ‘Locked’ to the cell ”Document Status”. After that, save the invoice.

When an invoice is locked, the accounting entry related to the invoice is also locked automatically. If you wish to amend anything on the locked invoice, select ‘‘Confirmed and Opened’’ in the ‘’Document Status’’ cell. You will need to save all changes to apply them.

Locking an entry

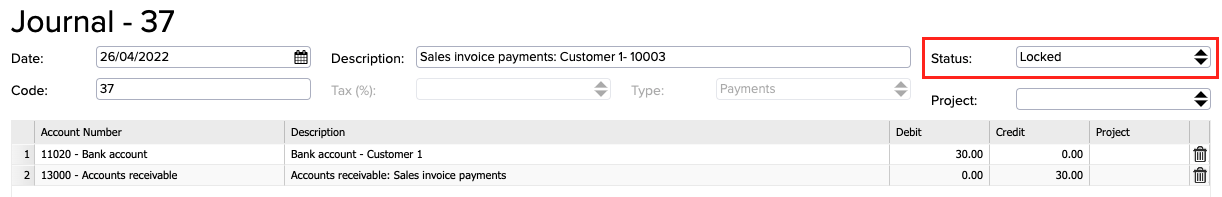

All entries can be viewed on the page Accounting -> Transactions or by choosing an entry from a specific transaction, ticking the invoice, and pressing More -> Transactions. An entry can be locked by choosing ”Locked” in the ”Status”. If you want to change the locked transactions choose ‘’Confirmed and Opened’’ as the entry status. You will need to save all changes to apply them.

Closing a period

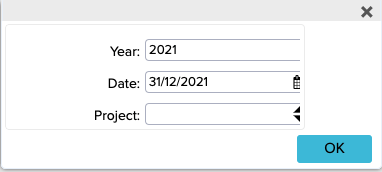

You should close a period if you have completed the accounting for a certain accounting period, submitted all reports, and are starting a new period. In such cases, you can close this period on ERPLY Books and start a new one. You can only close periods by years; this is usually used when a financial year ends. To close a period, type ”Year-End Closing” in the search box of the home page. A window will open, in which you should choose the year to close. Choose the date of creating an entry and press OK. Then, ERPLY Books will create the entries for closing a period.

When a period is closed, the system will set the balances of all income and expenditure accounts to zero and calculate the profit (loss) of the reporting year based on the sum of the balances. The ‘‘Add Opening Balance’’ window will open, where you can see your account balances as at the closing date of the period. In this window, you can verify that all income and expenditure accounts have been set to zero.

The entry for closing the accounting year is as follows:

D: Income accounts

C: Expense accounts

C: Profit (loss) of the accounting year

The profit (loss) account for the financial year must be an equity account. To set up an account, go to “Settings -> Initial Data -> System Accounts” and assign the account to the “Profit (loss)” line.

If you wish to undo closing the period, you will need to go to Accounting -> Transactions , find the respective trasnaction (e.g. by type – closing entries), and delete it.

Then, you can create a manual entry about distributing profit. If the profit or loss of the accounting year is transferred to the undistributed profit account for previous periods, a manual entry will have to be made for this purpose in the following financial year:

D: Profit of the accounting year

C: Undistributed profit of previous periods