If the balance doesn’t match the receivables?

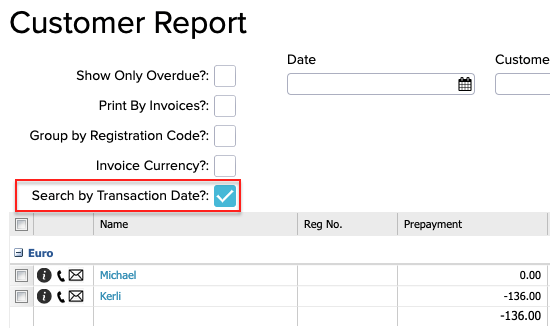

The first step in order to find out if the balances are the same is to compare the Customer Report and the balance.

- For seeing the balance open Reports -> Balance Sheet

- For seeing the Customer Report open Sales -> Customer Report

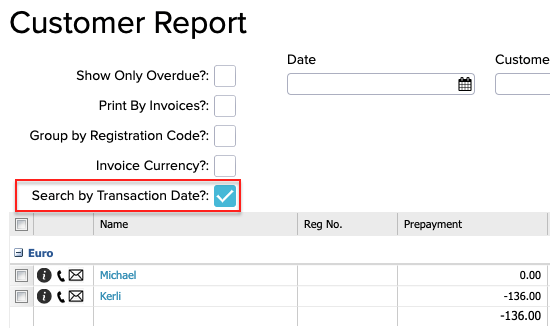

- Enable the ‘’Search by Transaction Date?’’ cell in the Customer Report.

If the balance is the same in both modules, your Receivables match with the Balance.

If the balances are not the same:

- First you have to check if the ‘’Receivables’’ has one or multiple accounts. You can see this if you go to the Balance sheet and put a check mark in the ‘’Detailed’’ cell.

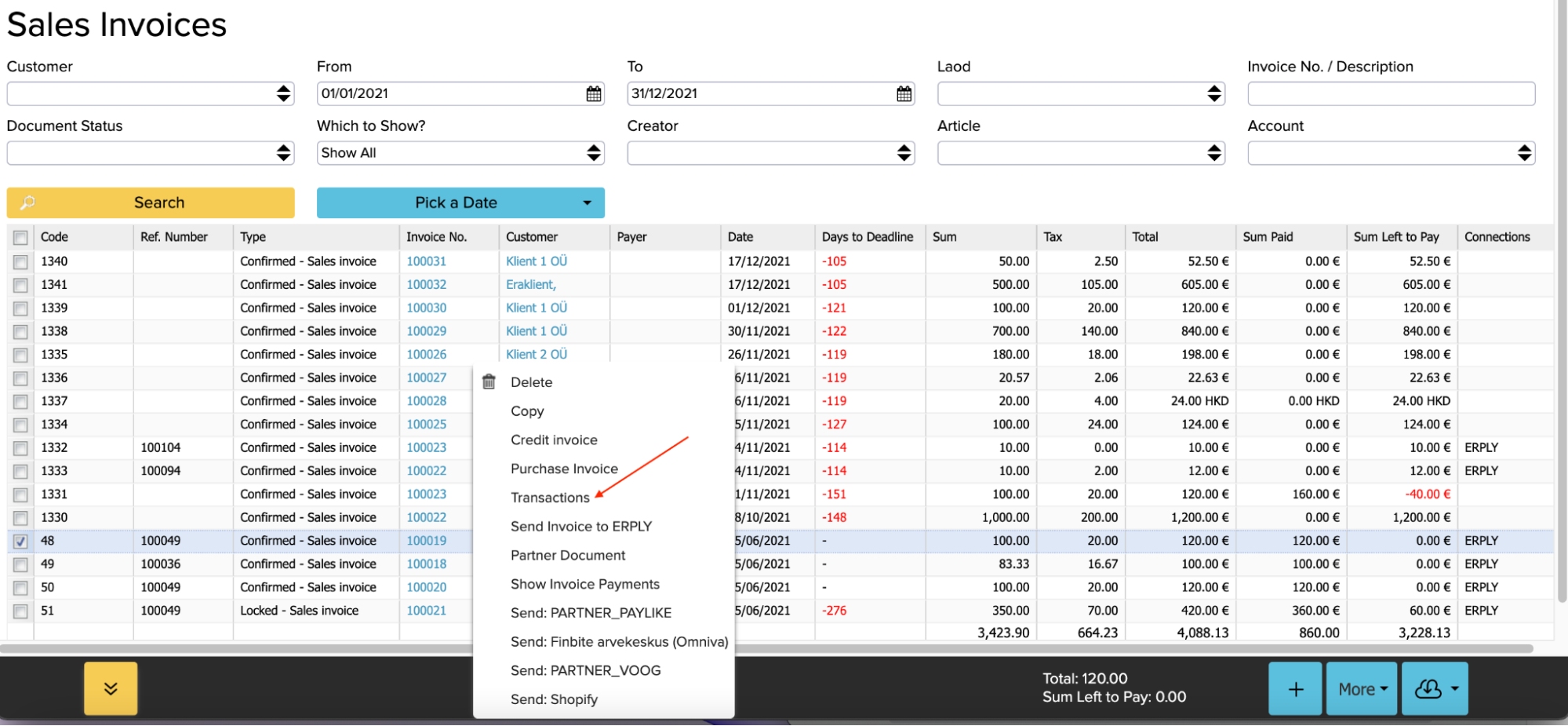

- The next step is to choose a sales invoice that is partly or fully paid, do a right click on the invoice and select ‘’Transactions’’.

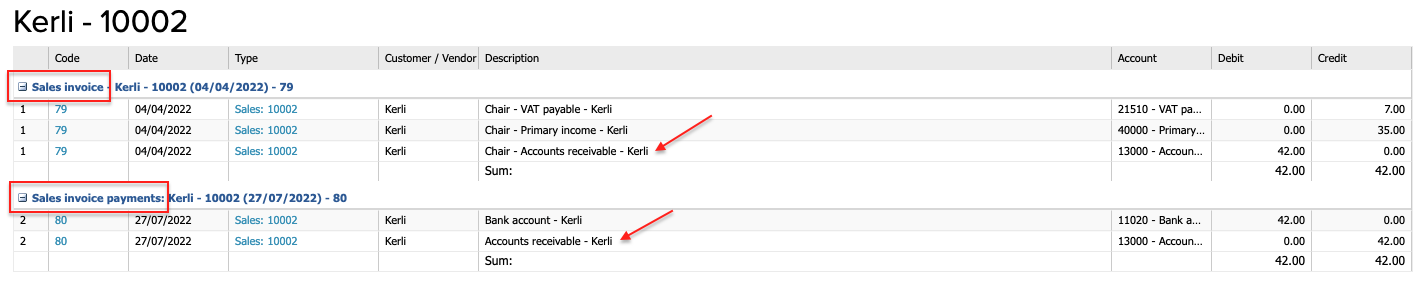

- Now in the opened window you can see the transactions that are connected to this sales invoice. Transactions connected with the sales invoice are shown in the upper red box and transactions related to the payment are shown in the lower red box.

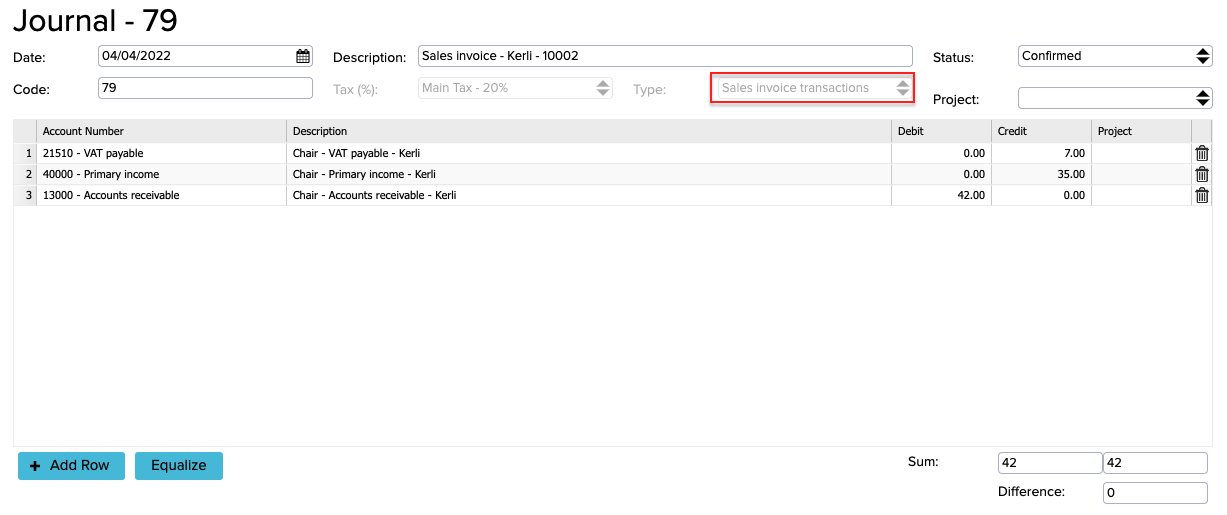

- Now check the transactions of the sales invoice and invoice payments. Do a double click on a sales invoice transaction (shown with the upper red arrow). The transaction type has to be ‘’Sales invoice transactions’’.

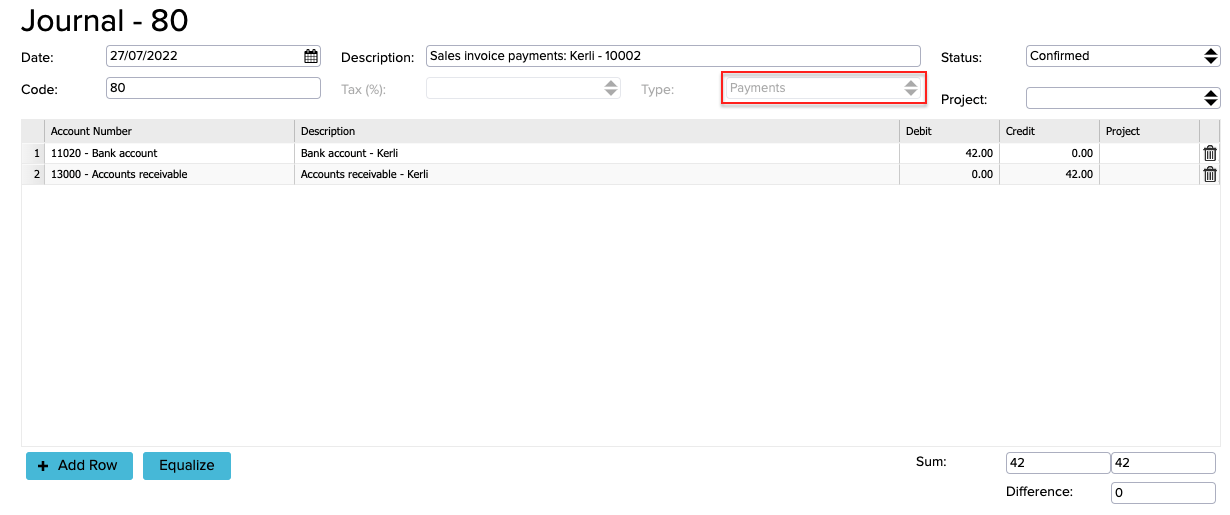

- Now check the payment transaction with a double click (shown with the lower red arrow). The type needs to be set as ‘’Payments’’.

There cannot be any transaction types in the Receivables account except for ‘’Sales invoice transactions’’ and ‘’Payments’’.

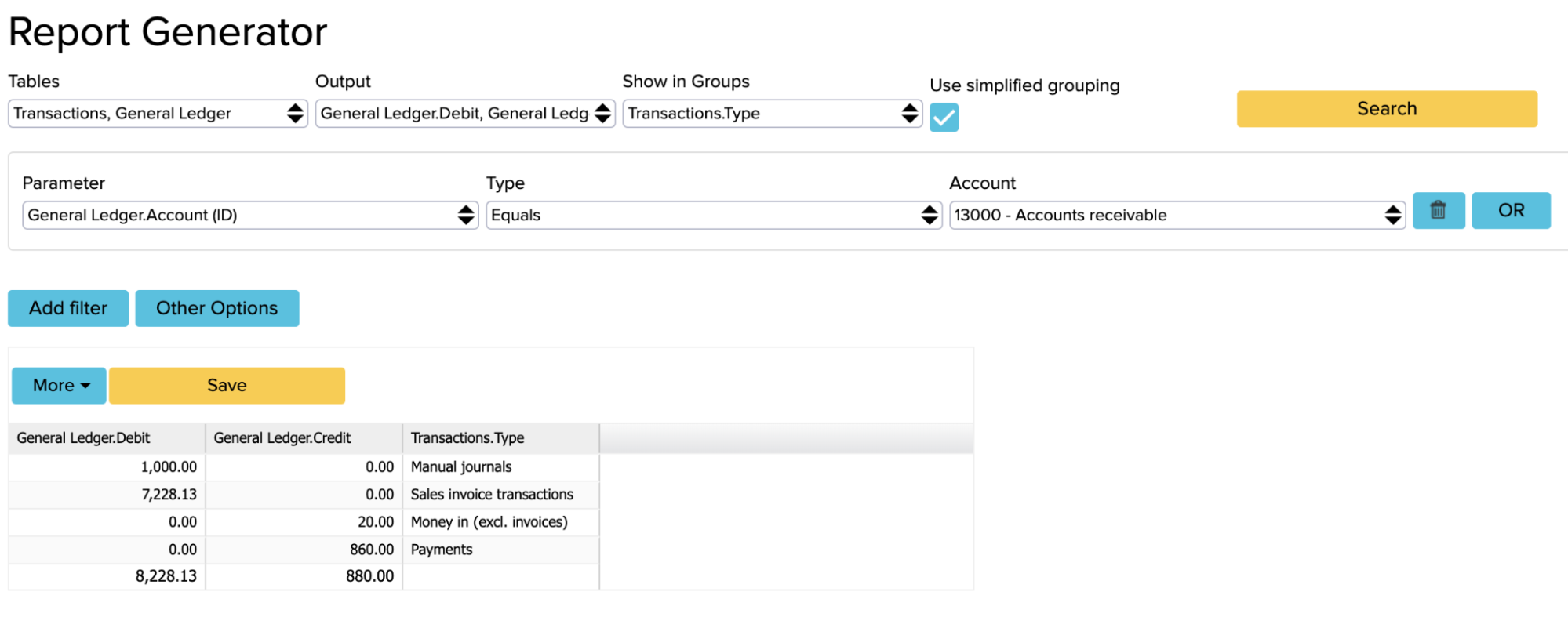

If you compare the Balance and Receivables balances and they appear not to match, you need to go to the Report Generator (Reports -> Report Generator) and compile a report to find out what type of transactions are used in the Receivable account.

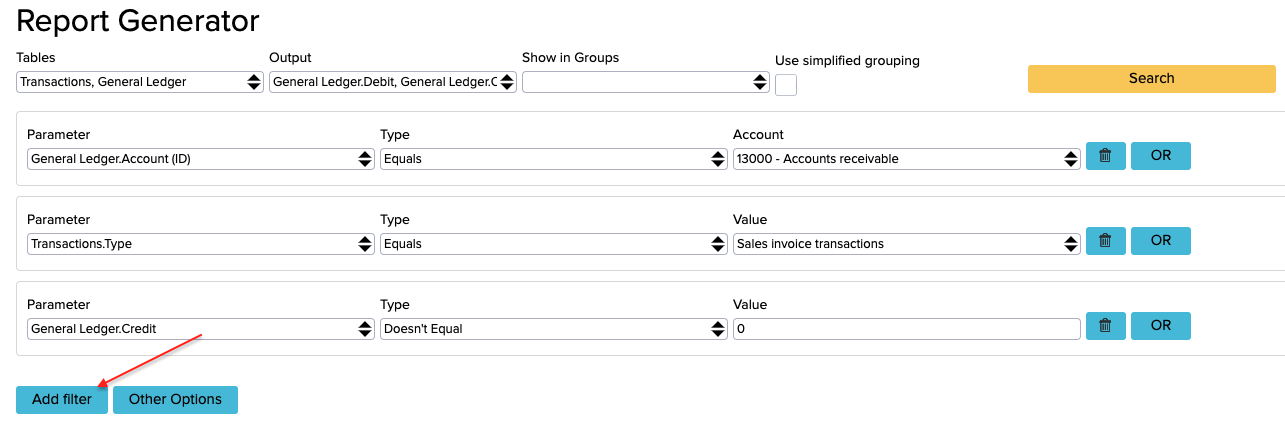

Make the following selections in Report Generator:

- Tables: Transactions, General Ledger

- Output: General Ledger.Debit, General Ledger.Credit, Transactions.Type

- Show in Groups: Transactions.Type

- Put the checkmark in the ‘’Use simplified grouping’’ cell

- Click on the blue button named ‘’Add Filter’’ to add a parameter.

- Parameter: General Ledger.Account(ID) Equals 13000-Accounts Receivables

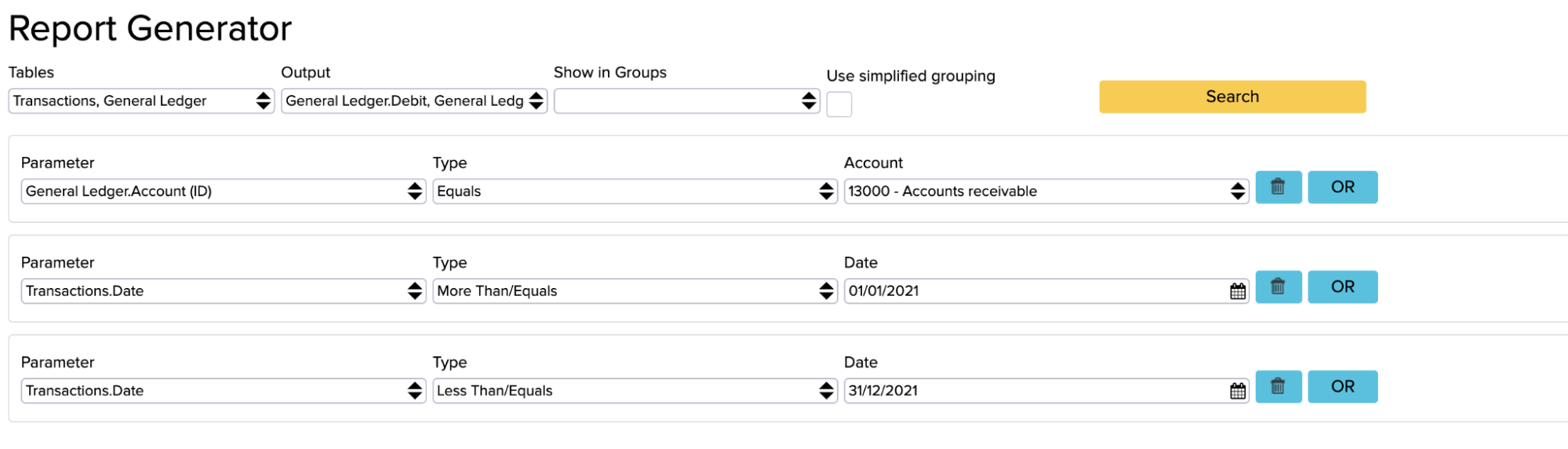

If you are looking at transactions from the beginning, you don’t have to add date parameters. If you want to search the transactions of a certain period (for example the year 2021) then you can add date parameters as shown in the picture below.

Manual journals

If the Manual journals row appears in this report, please note that Manual entries can be used only if the debit and credit are equal. If you see in the report that there is a difference between debit and credit, it means that you should fix the Manual journals (delete or add manual entries).

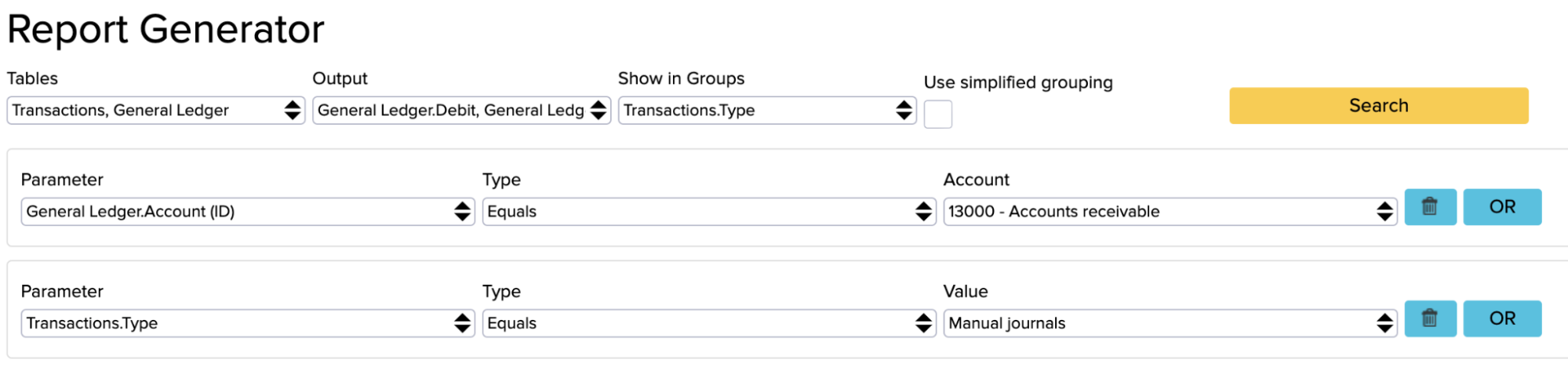

Compile the following report to see all Manual entries transactions:

- Tables: Transactions, General Ledger

- Output: General Ledger.Debit, General Ledger.Credit, Transactions.Type

- Show in Groups: Transactions.Type

- Don’t add the check mark in the ‘’Use simplified grouping’’ cell.

- Click on the blue button named ‘’Add Filter’’ to add 2 parameters.

- Parameter: General Ledger.Account(ID) Equals 13000-Accounts Receivables

- Parameter: Transactions.Type equals Manual journals

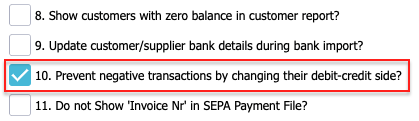

When the sales happen, the Receivables account increases and it must be in debit. There can be a credit amount in the manual journal column only if it is due to the rounding amount that is going to the opposite side. For this, the rule ‘’Prevent negative transactions by changing their debit-credit side?’’ under configuration (Settings -> Configuration) needs to be enabled. If it is disabled, there cannot be anything in the credit column by default.

Sales invoice journals

If the Sales invoice transactions are shown in the first report generator’s report and there is an amount in the credit columns, then you have to find out where this is coming from.

You can see sales invoice transaction details when you create a report with the following options:

- Tables: Transactions, General Ledger

- Output: General Ledger.Debit, General Ledger.Credit, Transactions.Date, Transactions.Description, Transactions.ID

To add parameters, click on the blue ‘’Add filter’’ button. Add three parameters as shown in the following picture and click ‘’Search’’:

From there, small amounts can come out from some invoices and it is not really important. However, if bigger transaction amounts appear, then the invoices that generated these transactions should be opened and checked in case there are both debit and credit transactions on the invoice rows as this should not happen.

Invoices with incorrect transactions

You cannot choose the types of transactions yourself (for example sales invoice transactions) because the system doesn’t allow this. Therefore, these transaction types appear due to real invoices. You need to check if a transaction is wrong on any invoices.

To do so, you can use the dashboard search box to open ‘’Find Invoices with Potentially Incorrect Transactions’’. There you can see the invoices which should definitely be reviewed.

- The problem can be that sales invoice transactions do not match with payment transactions. In this case, you need to ensure that the debits and credits of the sales invoices do not differ from the debits and credits of the payments of the sales invoices.

It is essential that all invoices with incorrect transactions are checked.

One reason why invoice transactions are incorrect could be that the transactions have been manually edited.

If the invoice comes from ERPLY Inventory, it is synchronized to ERPLY Books. The old transaction will be deleted and then a new transaction is created. However, if the editor and editing date are shown on the invoice transactions, it means that this invoice is not synchronized from ERPLY Inventory and it has been edited manually in ERPLY Books.

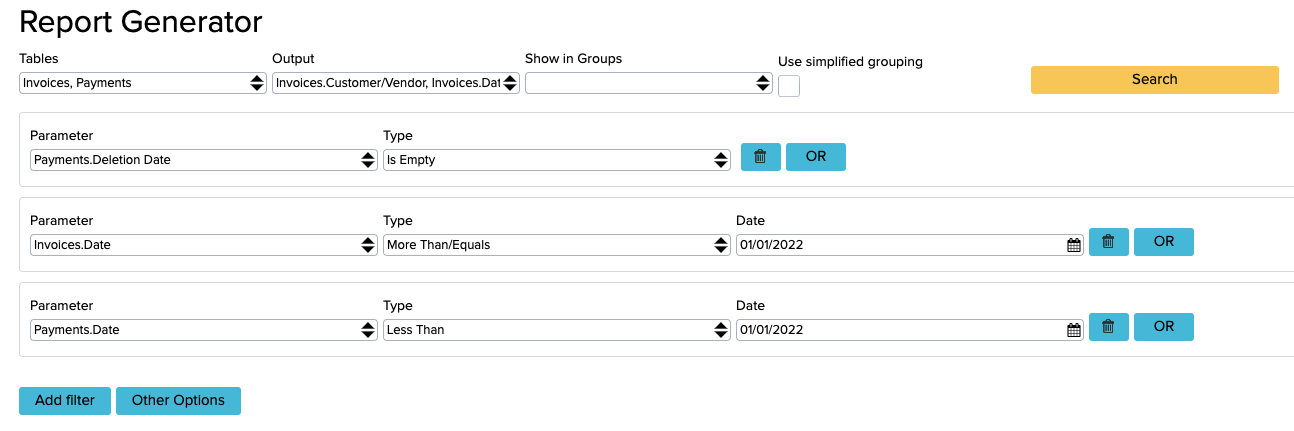

Difference between the invoice and payment dates

A difference between the balance sheet and receivables balances can also be caused by the invoice date being later than the payment date.

Let’s compile a new report in the Report Generator to establish the payments that have an invoice date in the future. For example, a period where the payments are made before 01/01/2022 but the invoice creation date is later than 01/01/2022.

Tables: Invoices, Payments

Output:

- Invoices.Customer/Vendor

- Invoices.Date

- Invoices.Invoice No.

- Invoices.ID

- Invoices.Invoice Total

- Invoices.Type

- Invoices.Transaction Date (because transactions are shown by transaction date but all reports by invoice are shown by default by invoice date. If this is a concern, it is also possible to search by transaction date in the Customer Report ‘’Sales -> Customer Report’’)

How to arrange differences between Accounts Receivable and Balance Sheet balances?

The Balance sheet and Receivables balances can be adjusted in two ways.

1. Old periods can be unlocked

The first option is to unlock old periods and make the changes straight on the invoice. Using this solution also means that you are changing the previous period’s data.

1. Before doing the changes, check that the period you are going to edit is locked in ERPLY Books

- If you have finalized the previous financial year’s periods, then before making any corrections delete the period’s closing transactions.

- The closing entries need to be deleted for the period in which the earliest changes occur as well as for all subsequent periods.

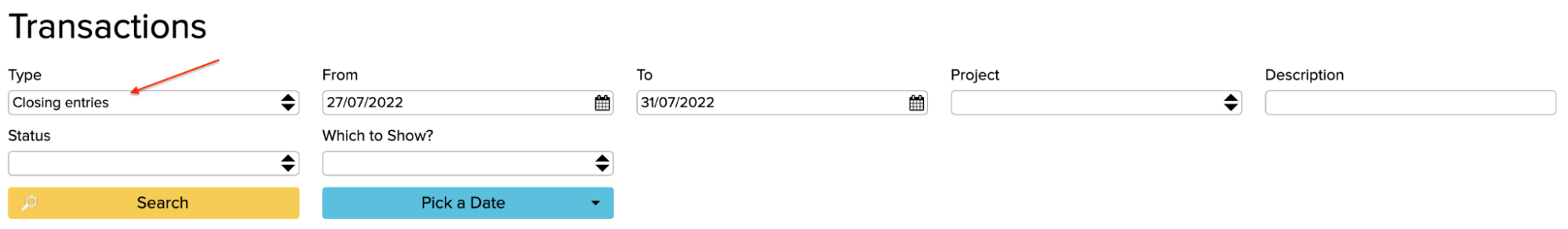

- You can find closing entries from ‘’Accounting -> Transactions’’

Then select the correct period from the ‘’Pick a Date’’ cell.

Select the type ‘’Closing entries’’.

2.

3. Open the module ‘’Find Invoices with Potentially Incorrect Transactions’’ and select ‘’Sales invoices’’. Open all invoices and their entries on the list one by one and make corrections. The entry needs to have a Receivables debit equal to the Total amount on the invoice line.

4. Correct the information on the invoices that have credit transactions in the Receivables account. For that, the sales invoices for the dates of the problematic invoices should be synchronized from the warehouse again or the invoice should be corrected based on the data of the warehouse invoice and the corrections should be locked afterwards.

5. The difference between manual entries must be transferred to the expense account.

After completing these corrections, it is important to check the previous period’s VAT reports because the data have changed.

2. Old periods cannot be opened

The second option is when the previous periods cannot be opened and all the changes must be made in the latest periods. This solution to the problem doesn’t change the previous year’s data. In this option, a manual entry is added to this year when the difference appears and the difference between the debit and credit of the manual entries revealed from the first report generator results is corrected.

In this case you have to keep in mind the last Report Generator result where you found out that the Receivables account is decreasing but the invoices are in the future. Essentially, this amount is prepayment and to figure out what is the correct amount on the Balance sheet and Receivables account you need to create two manual entries.

For example, at the end of 2021, the Receivables account has reduced by €7,000 (because the payment has already been received), but the invoices are in 2022.

In this case, the first entry should be made in the amount in which the Receivables to buyers have decreased due to prepayments as of 31.12.2021:

- D Accounts receivables 7000

- C Customer prepayments 7000

Now open again “Open sales invoices” with the same date and compare this with the same date of the balance sheet. The difference how much the Balance sheet balance is bigger than the Accounts Receivable balance must be charged to your chosen expense account on 31.12.2021 with the entry:

- D Expense account

- C Accounts Receivable

The third entry in order to return prepayments to the Account Receivable must be made on 01.01.2022:

- D Customer prepayments 7000

- C Account Receivable 7000

To avoid the situation where prepayments arise because of completed payments with an invoice date that hasn’t arrived yet, you can enable rule number 53 in Configuration (Settings -> Configuration).

![]()