Rules for rounding

There are three main rules for rounding that you should follow:

- “Digits after rounding”. You can find this in “Settings” > “Configuration”. This determines how many digits you use on invoice for rounding.

- The main rounding rule is the half even.

- Rounding on invoice: each row rounds according to the rules that you have set in “Configuration”. These rows are summing up. Therefore, net and gross amounts are based on the rounded amounts not from rounding the total sum in the end.

Because the rounding rules are different in programs and in businesses, then there might be differences that you need to mark somewhere:

- If you want to round the net sum, use a invoice row. Change the sum on some row or add one row.

- When rounding the VAT, write the right VAT amount in the VAT cell. If the sum is bigger than one euro, you will get an error message, because you should correct the amount on the invoice.

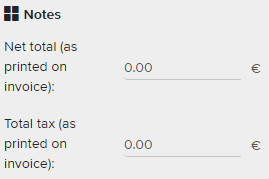

- When you are rounding the total sum, then open the extra information and mark there the rounding sum.

Different options when synchronising data from ERPLY POS:

- If you do not set default rules, then the system checks the differences in sums and places the differences on the rounding.

- “Synchronize Purchase Invoice Totals” – synchronize net and gross sums that are meant for accountant.

- Based on that, ERPLY Books checks if the net sum on the invoice is the same. Books places deficit and surplus on the last row on the invoice (It means when you divide invoices between different product groups (or between something else), the differences might cause problems).

- Additional condition: “Calculate rounding from invoice rows”. Because ERPLY might set up according to retail price (not wholesale price), then there might be differences between invoice net sum and net sum that is calculated from the invoice rows. In order to avoid that, you can activate an option, where ERPLY Books does not take net sum from the invoice, but calculates it while making transaction.“Match sales invoice net totals – round net total amount not total”. Sales invoices – synchronize in a way that the net sum is rounded, not the gross sum.

- You can find further information about ERPLY Books rounding rules in this video: