Bank reconciliation

ERPLY Books has two functionalities for managing bank transactions (of course there are functionalities to add payments manually) – bank import and bank reconciliation.

The first one, bank import is meant for recording bank transactions while importing the bank statement into ERPLY Books. Watch the video here.

The second, bank reconciliation is meant for confirming bank transactions.

You can use only bank import or only bank reconciliation. Or both. Or none of them. All options are available in ERPLY Books. Usually the decision how to manage bank transactions can be answered as follows:

Configuring bank reconciliation

1. To enable bank reconciliation rule go to ”Settings -> Configuration’‘ and find rule number 48 (Use bank reconciliation?) and click on ”Save”

![]()

2. If this is enabled refresh the page

3. Go back to Configuration and find the ‘‘Reconcile this account” option

Here you can and these accounts that you want to reconcile in the future (for example bank account, payment card account, check order account etc).

4. To add an account press on the blue ”Manage” button and then on the ”Add” button and choose correct account. If all needed accounts are added click on the ”Save” button.

- If you are not adding accounts here then they are not appearing in the renconcile module.

5. If all accounts are added and saved then refresh the page.

How to use bank reconciliation?

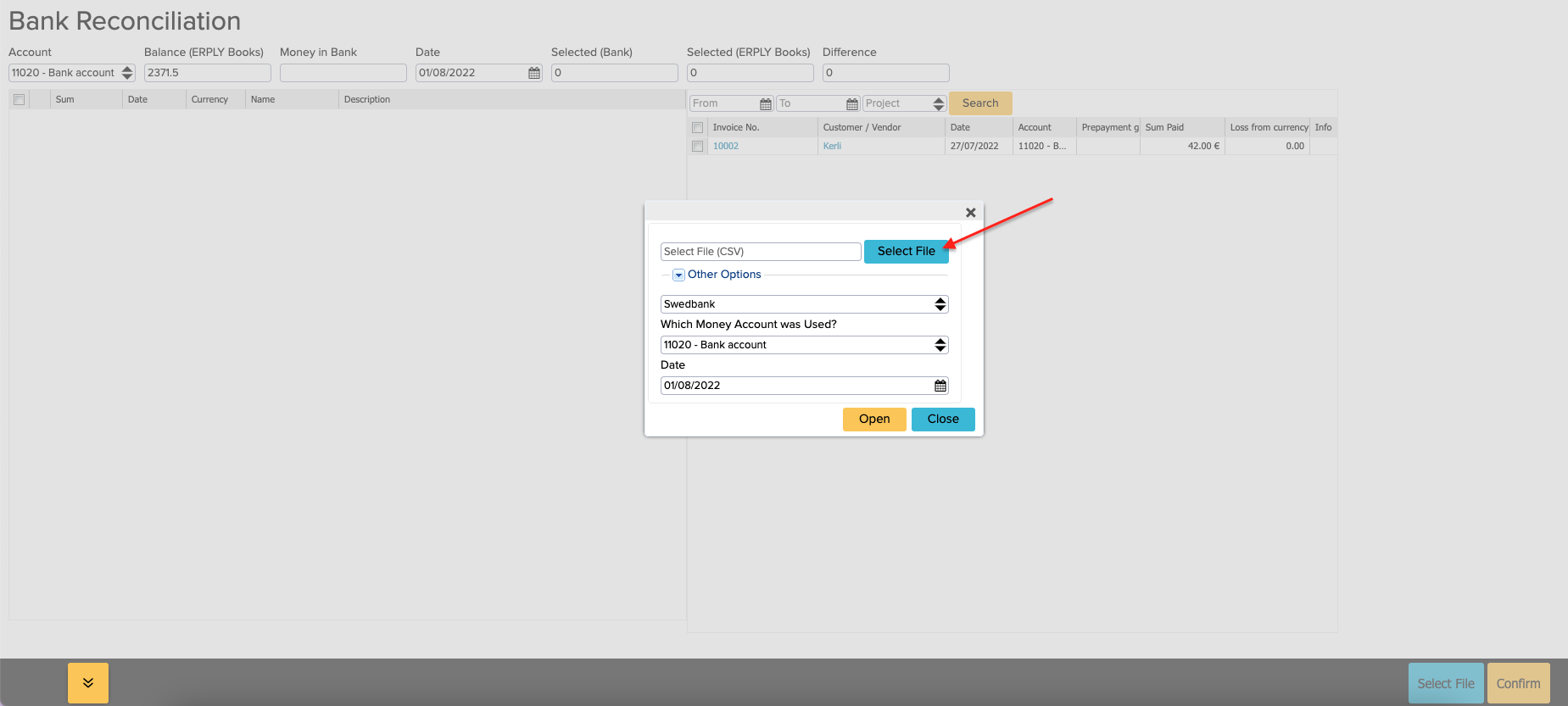

To open Bank Reconciliation module go to ”Accounting -> Bank Reconciliation”. Now opens a window where you have to upload a file by clicking on the ”Select file” button and then ”Open”.

On the left side are shown all transactions from the file.

- You have to select these transactions from the left side (add a checkmark to the box in front of the wanted transaction row) from the file which you want to reconcile

- On the right side choose these transactions that you want to settle connected to the left side transactions

- Click on the yellow ”Confirm” button.

1. ERPLY Books supports your bank statement importing, all transactions are understandable when importing the bank statement and there are no pending payments in your business.

This means the payment descriptions are enough to record the transaction without further looking into other statements. If yes then we recommend recording all bank transactions with bank import. When you have recorded all transactions then your bank balance is also ok. Follow those instructions:

- Import bank statement

- Make all transactions green and save

2. ERPLY Books supports your bank statement, only some transactions are understandable when importing the bank statement and/or there are pending payments in your business.

This means that some transactions have description like “CHECK” or “Payment” or something similar that you cannot determine so easily. In this option you can use both: bank import and bank reconciliation. Follow those instructions:

- Record check and other payments that you cannot record with bank import.

- Import bank statement.

- Make all transactions you haven’t recorded elsewhere green and save.

- Click “Bank reconciliation” under “Accounting” menu.

- Match manually recorded transactions with those that you haven’t yet recorded with the bank import.

- Make sure left and right side match and click confirm. Then ERPLY Books marks those payments as reconciled and makes sure those payments from left side won’t show up again when you do bank import.

3. None of the transactions are understandable when importing the bank statement.

Then you have to do only bank reconciliation. Follow those instructions:

- Record all payments in open receivables & payables and money in / out functions.

- Go to bank reconciliation module and upload the bank statement.

- Select payments from bank statement and payments you haven’t reconciled.

- Make sure left and right side match and click confirm.

4. ERPLY Books doesn’t support your bank statements.

Then you can not use bank import or bank reconciliation functionality and you have record bank transactions manually.

How to record bank transactions manually?

Sales invoice payments:

- Add invoice payments from open receivables

Purchase invoice payments – depends if you are making check payments or just adding payments manually:

- To add manually payment, go to ”Open payables -> Select invoice(s)” and click “Add payment”

- If you want to add simple expense invoice then click “Simple expense” from the dashboard

If you need to use check process, then:

- Go to open payables

- Select invoices you want to mark as payables

- Click “Export payments to file”

- There you can edit data if needed and add other payments if needed

- If everything is set then click “Export payments to file”

- After you have printed out check and mailed it you can click “Mark as paid” (optional, not compulsory) – then ERPLY Books adds payment to all of the selected invoices*

- If you need to manage positive pay process then from there click “Print” -> “send by email”

Non-invoice transactions:

- You can add simple money in from the dashboard

- You can add simple money out from the dashboard

- More complex transactions (like payroll etc): add manual journal and make sure you select “Money out (excl. Invoices)” or “Money in (excl. Invoices)” from the type

Other questions about bank reconciliation:

Which accounts are reconcilable?

- As you can have many money accounts including cash then all of them don’t need to be reconciled with the bank reconciliation. Thus we need to select accounts we need to reconcile. You can do this from the global attributes.

How to mark payment as unreconciled?

- Go to ”Reports -> Money in and and out”;

- Select payments you want to unreconciled;

- Click “More” -> “Mark as Unreconciled”.

How to see which payments are unreconciled?

- Open Bank Reconciliation module and click search

How to create transactions not created with bank?

- Sales invoice payments

- Add invoice payments from open receivables

- Purchase invoice payments

- Open payables

- Check payments

Non-invoice transactions:

- You can add simple money in

- You can add simple money out

- More complex other transactions

How to see if bank balance is ok?

- Easiest would be to see them in account balances

ERPLY Books uses pending money account from system accounts (Settings -> Initial data -> System accounts) for check payments. Also if you are doing bank reconciliation then your check payments should be added straight into bank account not any clearing account! And if you have multiple bank accounts where you make check payments then please mark those payments manually not with “Mark as paid” button in the check printing module.