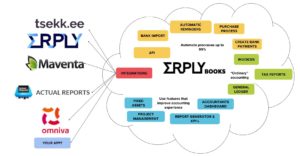

ERPLY Books has all the necessary features to manage your accounting. On top of “ordinary” features there are all kinds of “bells and whistles” for accountants that help to automate the data entry and improve the reporting.

How ERPLY Books works?

ERPLY Books has many features that automate accounting processes for accountants and improve the accounting experience. To see the full list of functionalities, look from YES LIST.

The next paragraphs show the key features we think might be valuable for you. If you have additional questions how those processes work, then all of them are provided with tutorial links and we are happy to answer additional questions by phone/email.

Accounting

ERPLY Books covers all the accounting related operations and much more. Small businesses can use all the default settings and enterprises can adjust the software according to their necessity.

|

Cloud-based accounting platform

Cloud-based accounting platform

ERPLY Books is easy-to-use cloud-based accounting software that can be used by small and very large companies.

- ERPLY Books can be used in every place and device that has internet access and web browser;

- The software is constantly updated and updates are done in real time, which does not require you to make any additional moves;

- You can connect other software with ERPLY Books- Make API integration by yourself, use already existing integrations or functions, which help to import or export information.

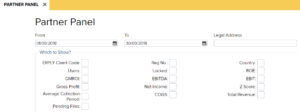

Managing multiple organisations

ERPLY Books is perfect if you have many organisations – whether you are an accountant and have multiple customers or you are a business owner with multiple companies.

- All the information is accessible from everywhere and with a single sign in;

- You can download tax reports, manage purchase inbox and bank import using cross organisational management panel – no need to go from one organisation to another;

- You can see cross-organisation reports.

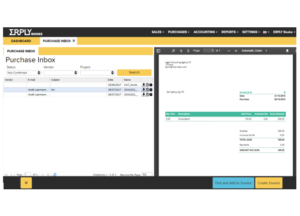

Purchase inbox

Purchase inbox

Purchase inbox can save you 80% of time spent managing purchase invoices. Every organisation has its own unique email address, where suppliers can send their invoices. Purchase invoices that have been sent on to this email are easy to record: on the right you see the invoice; on the left you can enter it.

- Give your suppliers your ERPLY Books’ email. Sent emails and attached files will be saved and archived immediately to ERPLY Books;

- All documents are in one place and archived so none of the documents go missing;

- PDF parser and processing e-invoices automatically, helps with compiling invoices;

- Archive picture/PDF/e-invoice, compile payment files;

- E-invoices – ERPLY Books supports Unifiedpost and finbite e-invoice solutions. Automatical configuration saves time on manual data entry.

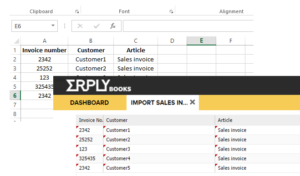

Importing everything

There are automated options to import all the necessary lists to ERPLY Books: invoices, payments, customers, articles, accounts and even invoice rows.

- When importing more than 1,000 invoices, use the CSV file;

- Import small amounts of data (up to 1,000 rows) by copying it from a spreadsheet, then in Books make the column “blue” and then click ctrl+v;

- If you need regular imports then you can learn more about our API – maybe there is an option to make the integration.

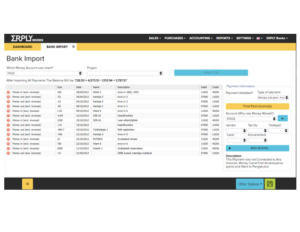

Bank

Bank

With ERPLY Books you can import your bank statement and download payment file that you can upload to the bank.

- Bank import can recognise up to 100% of the transactions automatically;

- You can automate bank import even more through different bank rules;

- ERPLY Books supports all EU, US, AU, ZA, CA banks some other banks (including PayPal) all around the world. If we don’t support your bank, then you can add and build the rules by yourself.

- Create payment files (print checks, remittance advices or create SEPA/ABA files) for purchases, salaries, prepayments and other payments;

- If paying multiple invoices to one supplier, then it will create one payment.

Flexibility

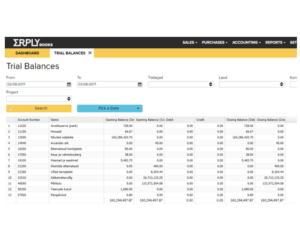

When creating a new organisation in ERPLY Books, all the rules are set to default. But everything can be changed – when you are a small organisation, use software as it is, when you are larger then change everything to automate and fit your needs.

- Personalised chart of accounts and VAT rates – send us question how to get the same chart of accounts to all your organisations;

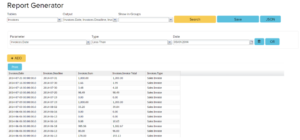

- If there aren’t reports in standard reports list then you can create them using report generator;

- Build your own P/L and/or balance sheet;

- Reports can be seen in different currencies;

- Automate bank by adding different rules;

- Automate rules for purchases – in order for ERPLY Books to import purchase invoices automatically.

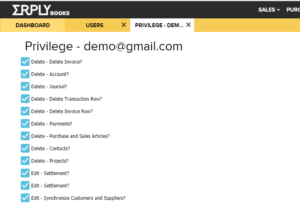

Enabling access to users

Enabling access to users

You can assign different privileges to users.

- Disable everything user should not have access to;

- Manage users so that only authorised people have access to your account.

Track emails you send to customers/suppliers

ERPLY Books tracks emails that are sent from the software.

- See whose emails have bounced and whose emails have been received (and also opened);

- Track different types of operations: sending invoices, payment reminders, supplier balance statements;

- Use email status reports along with recurring invoicing option and automate invoicing process as much as possible.

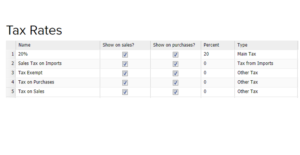

VAT / GST / Sales tax

ERPLY Books offers all the features that you can imagine about sales and purchase taxes – from tax calculation, additional transactions and reverse taxes to country specific reporting.

- You can add unlimited amount of tax rates;

- ERPLY Books knows what you need if you are doing business in EU;

- Taxes have multi-level rules: connect them with the account, customer or even customer group;

- Calculate taxes from prepayments automatically.